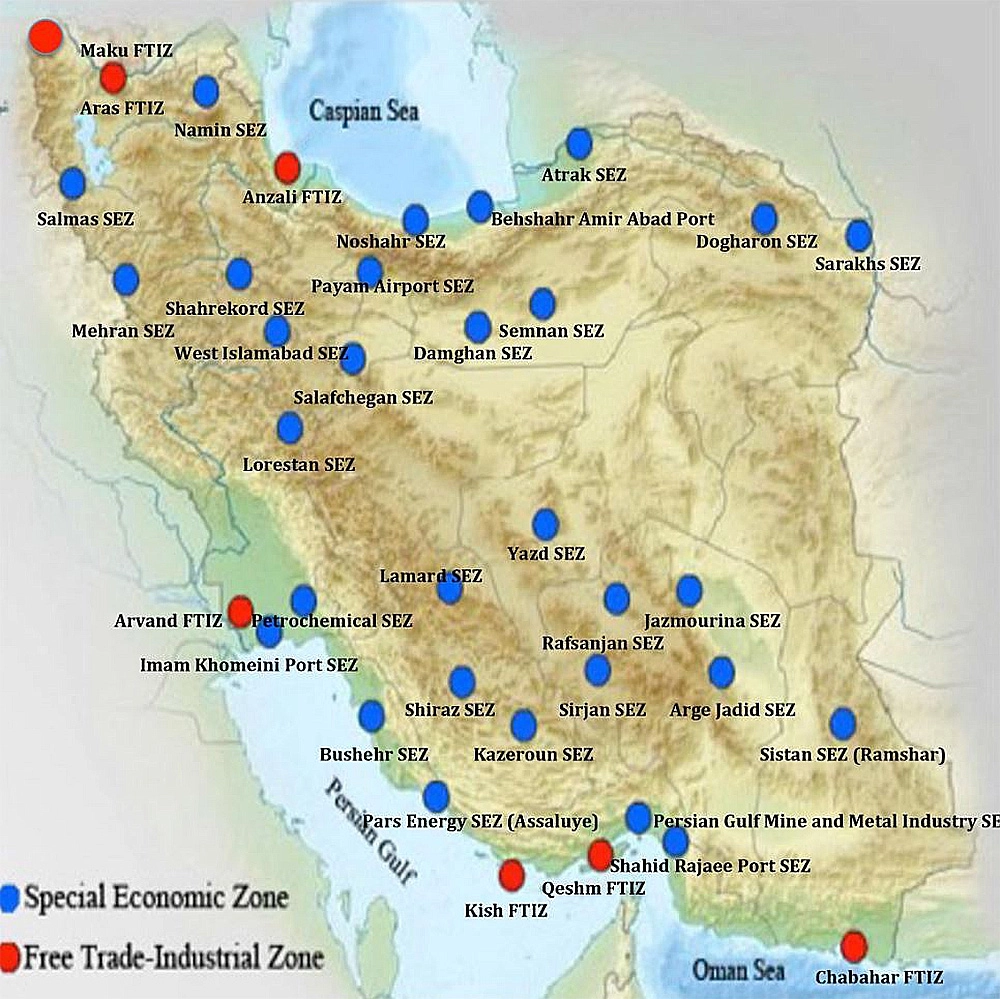

Free trade zones and special economic zones in Iran

The potential of Iran's economy and the opportunities created by the legal framework with enabling laws have made Iran an attractive option for investment.

2024/11/4

114