Benefits of special investment zones in Turkiye

Table of contents

Table of contents

Turkiye is a country where the support of investors and businesses is one of the main strategic objectives of the government. As an effective tool for developing the economy and improving living standards, various investment zones operate in the country.

Organized Industrial Zones (OIZs)

OPZ — these are sectoral territorial-industrial associations, which are created both for large enterprises and for smaller workshops, warehouses, etc. In these territories, there are special benefits in taxation, lending, the cost of energy resources and other incentive measures. HMOs are designed to form business clusters with the most favorable support regime. The industries there are the widest, from tourism to the agro-industrial complex.

Across the country, 263 organized industrial zones have been established in 80 provinces, with a total area of 27,542 hectares. To date, 148 zones — operating, and 115 are in the process of creation. The number of companies operating in the Organized Industrial Zones in Turkiye currently stands at 41,608 firms with over 1,200,000 employees. In the future, it is planned to increase their number to 2 million at the time of commissioning of all production facilities, which are now at the design stage. As for their territorial location, on the Aegean coast — 22% (where Izmir is the most prominent), in the Marmara region — 21%, on the Black Sea coast — 17%, in Central Anatolia — 16%, on the Mediterranean coast — 9%, in the region of Eastern Anatolia — 8% and in Southeast Anatolia — 7%.

There are all communications on the territory of the OPP, and there are also subsidies for each industry and each region, and you can make the most of them by placing your business in an industrial zone.

Each region of Turkiye is evaluated in each industry on a 5-point scale. The number of subsidies depends on the accrued points, and the higher the score, the more and more programs there are to stimulate the industry. It is noteworthy that the Industrial Zone always has an additional +1 point.

Technological Development Zones (TDZ)

In the 1990s, Technological Development Zones (TDZ) or the so-called "Technoparks" began to be created in Turkiye. Technoparks operate in various regions of the country, and a total of 50 were created. To date, 34 technoparks are active. All conditions have been created here to support research activities and invest in high technologies. Of these, in Ankara — 6, in Istanbul — 5, in Kocaeli — 4, in Izmir — 3, and 1 — in each of the provinces (Bursa, Eskisehir, Kutahya, Manisa, Denizli, Antalya, etc.). There are about 1,200 companies in actively operating technoparks in Turkiye. Each technopark has its own profile, supporting benefits here or another industry.

Advantages of technology parks (TDZ) and benefits that are provided:

- Profits derived from software development and other research and development are exempt from income and corporate taxes until December 31, 2023;

- Profits from sales of application software released exclusively in technology development zones are exempt from VAT until 12/31/2023. This includes software for management, data management, applications for solving business problems in various fields of activity, the Internet, mobile phones , as well as military operational control systems;

- Until 12/31/2023, the wages of R&D and service personnel working in the process area are exempt from all taxes. The number of service personnel covered by this exemption must not exceed 10% of the total number of employees employed in R&D;

- At the discretion of the management company and with the permission of the Ministry, enterprises may make investments necessary for the production of technological products resulting from the implementation of R&D projects in the technological development zone.

- 50% of social insurance payments will be covered by the government in favor of employees for 5 years until 12/31/2024.

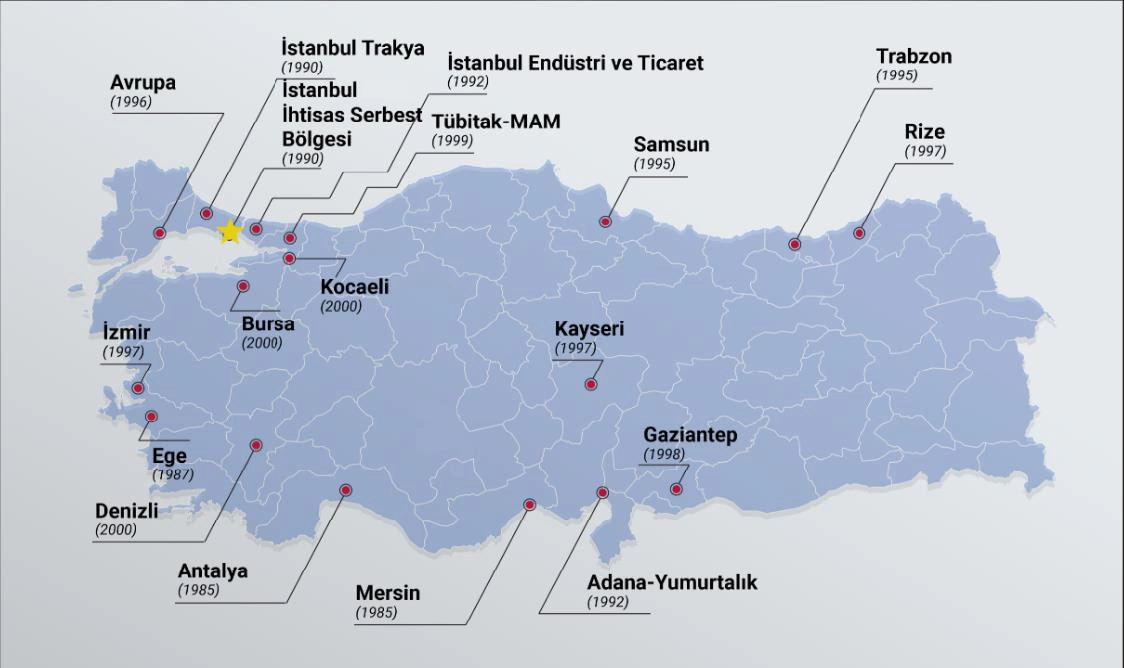

Free economic zones (FEZ)

The creation and operation of free economic zones (FEZs) in Turkiye is regulated by Law No. 3218 of June 6, 1985, with subsequent amendments and additions.

These zones are defined as special areas that are not subject to the regime of the customs territory of Turkiye, the legal regulations governing export-import and foreign exchange transactions do not apply in the territory of free zones.

There are no procedural restrictions in the FEZ regarding prices, standards and quality of goods provided for by Turkish law: any decisions taken by state institutions or agencies regarding prices, quality and control, which are mandatory throughout Turkiye, do not apply in the territory of the FEZ. These zones are created to increase investments that are export-oriented. Despite the fact that FEZs are located within the borders of the Republic of Turkiye, they are considered as foreign territories.

Unlike most FEZs in other countries, the FEZ regime in Turkiye allows the supply of goods produced in the FEZ to the Turkish domestic market, however, such supplies are subject to the foreign trade regime (with payment of 0.5% tax on the transaction amount). At the same time, if the cost of goods does not exceed $ 500, then they are exempt from taxation. The foreign trade regime does not apply to goods supplied from FEZs to other countries or other FEZs.

In the FEZ, any type of freely convertible currency quoted by the Central Bank of Turkiye can be used as a means of payment. The Council of Ministers may decide to make payments in Turkish Lira.

The location and boundaries of the FEZ are established by the Council of Ministers of Turkiye. The issuance of licenses for the right of entrepreneurial activity in the FEZ is also under the jurisdiction of the Council of Ministers.

Local and foreign individuals or legal entities carry out their activities in accordance with the license issued by the General Directorate for FEZ Affairs, which is part of the Office of Foreign Trade of the Office of the Prime Minister of Turkiye. All other permissions — on land lease, construction and use of real estate, installation work, etc. — issued by local governments.

With regard to accounting and financial reporting, the Ministry of Finance is authorized to carry out the necessary regulation and instructions in this area, regardless of the provisions of the general tax legislation of Turkiye, and submit relevant proposals to the Council of Ministers.

Law No. 5084 of February 06, 2004 on the promotion of investment and employment provides that persons operating in free economic zones are subject to taxation under the following conditions:

- Revenues arising from the sale of goods produced in these zones by natural or legal persons who obtained a license on 06.02.2004 and later are not subject to income or corporate taxes until the end of the tax period of the year in which Turkiye becomes a full member of the European Union.

- With the adoption of the FEZ Law, more than 20 FEZs have been established and are operating in Turkiye. Here, such types of entrepreneurial activities as production, storage, packaging, trade, banking, insurance, etc. are conducted and encouraged.

- In accordance with the Law, profits and incomes can be transferred without restrictions to any country, including Turkiye.

- Validity of a business license is a maximum of 10 years for entrepreneurs — tenants and 20 years for those who acquire office and work premises in the property. If the license provides for the implementation of production activities, then its term is respectively 15 and 30 years for users and investors.

- Goods can remain in the FEZ without time limits.

- There are no restrictions on the ratio of foreign and local capital when investing in SEZs.

The geographical position of Turkiye contributes to the successful development of SEZs, which are located in the main Turkish ports of the Mediterranean, Aegean and Black Seas and international airports.

Since FEZs are part of a common customs territory with the European Union, goods produced in FEZs and in free circulation can be shipped to EU countries in accordance with the ATR certificate. Goods produced in third countries are also not subject to customs duties when they are delivered to the FEZ. However, goods that are not in free circulation can only be shipped to EU countries in accordance with the ATR certificate by paying customs duties at the rates determined by the Common Customs Tariff with the EU.

Licenses for doing business in the FEZ are issued by the General Directorate of the FEZ of the Ministry of Foreign Trade.

A separate advantage is the minimal state intervention in the activities of a business located in the FEZ. Thus, free zones reduce the tax burden, as well as facilitate lending and investment. It should be noted that there are many free economic zones in the country — almost three hundred and each has its own profile. Because there is real competition between them.

(Based on the website of the Embassy of the Russian Federation in the Republic of Turkiye).

Other topics:

Other topics:

REAB Services

REAB Services

News

News

Useful tip

Useful tip