News

Follow the news of the REAB Consortium and the market, stay up to date.

Egypt is keen on further strengthening its strategic partnership with Russia in the fuel and energy complex, Egypt’s Petroleum and Mineral Resources Minister Karim Badawi has said. He has been meeting with Russian Energy Minister Sergei Tsivilev during a Russian State Duma delegation visit to Cairo.

The talks involved Duma Energy Committee Chairman Nikolai Shulginov, who announced the Duma members’ working trip to Egypt to discuss a legal framework for bilateral energy cooperation with Egyptian parliamentarians. Tsivilev said that “Russia remains Egypt’s reliable partner in mining projects. Russian companies are interested in long-term operation on the Egyptian market.”

Russia has several on-going projects in Egypt, including the long-awaited Russian Industrial Zone at Port Said which would facilitate the joint Russian-Egypt manufacturing of products for both export to the larger African market as well as potentially, Russia and the Eurasian Economic Union.

Egypt is in the final stages of negotiating a comprehensive Free Trade Agreement (FTA) with the Eurasian Economic Union (EAEU). Six rounds of negotiations have taken place to create a free trade zone, aiming to reduce duties to zero on over 95% of exports. It is expected to be signed later this year.

Russia is also involved in Egypt’s nuclear energy sector, with Russia committed to long-term supplies of reactor fuel and maintenance of Egypt’s nuclear power plant at El Dabaa.

The two sides are also involved in the oil sector with Russia drilling several blocks in the Sinai region. The Russian state-owned company Zarubezhneft has joined two major offshore oil blocks — South East Ras El Ush and East Gebel El Zeit — with resources estimated at over 200 million barrels. In August 2025, it signed a US$14 million deal to drill four wells in the onshore North El-Khatatba block in the Nile Delta.

Lukoil was awarded the South Wadi El-Sahl block in the Eastern Desert last year, committing to invest US$22.5 million to drill six exploratory wells. It also operates in the West Esh El Mallaha (WEEM) concession.

Beyond oil, Russia is involved in major Egyptian gas projects. Rosneft holds a 30% stake in the Zohr gas field, the Mediterranean’s largest, which has received specific sanctions exemptions from the UK to continue operations.

Tags:

Zimbabwe is intensifying efforts to secure BRICS membership as part of a strategy to broaden its international partnerships and strengthen its economic position, according to Amon Murwira, Zimbabwe’s Foreign Affairs and International Trade Minister. He said that Harare has approached BRICS member countries to push for quicker admission into the bloc, stating “Zimbabwe is ready to integrate more deeply into the global community, and joining blocs such as BRICS is very important for us in expanding our economic involvement and integrating Zimbabwe into the global economy.”

Murwira said President Emmerson Mnangagwa has tasked him to lead Zimbabwe’s engagement with BRICS member states. Zimbabwe also applied last year to join the New Development Bank (NDB), the bloc’s financial arm. The Zimbabwean president also discussed Harare’s intention to become a BRICS member with Russian President Vladimir Putin during talks in St. Petersburg in June 2024.

Last October, the Russian ambassador to Harare, Nikolay Krasilnikov, stated that Moscow “strongly supports Zimbabwe’s keen interest in engaging with BRICS” and is prepared to assist the African country in its pursuit of membership. He added that “decisions in BRICS are made by consensus” but that Russia welcomes Zimbabwe’s integration into the group.

BRICS was established in 2006 by Brazil, Russia, India, and China, with South Africa joining in 2010. In recent years, BRICS expanded its membership. It now also includes Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates, bringing its total to ten full members.

The group created a partner country category in 2024 to widen participation. Partner countries include Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, Uzbekistan, and Vietnam, allowing them to engage in select BRICS meetings and initiatives.

Zimbabwe’s economy is driven by a range of key industries, with manufacturing, agriculture, and mining playing significant roles. The manufacturing sector is dominated by iron ore, steel, and metal fabrication, which make up 26% of the sector. Other important industries include chemicals and petrochemicals, food processing, and beverages, each accounting for 14% of manufacturing output. Despite challenges, agriculture remains a crucial part of Zimbabwe’s economy, contributing around 15% to GDP. It employs more than half of the country’s workforce. Zimbabwe’s agricultural production is diverse, with crops such as maize (corn), the country’s most significant food crop, thriving particularly in the water-rich northeast. Other key agricultural products include tobacco, cotton, sugarcane, and various fruits and vegetables. Mining is also a vital sector for Zimbabwe, with notable resources such as gold, diamonds, platinum, and coal driving exports and foreign investments.

Zimbabwe is a member of the 16-nation Southern African Development Community (SADC), which aspires to enhance trade and economic cooperation as well as ultimate regional economic unification. Zimbabwe is also a member of Eastern and Southern Africa’s 22-nation Preferential Trade Area (PTA), which permits lower import taxes from its members as long as they follow specific origin regulations. South Africa, Namibia, and Botswana are all parties to bilateral trade agreements with Zimbabwe. Additionally, in 2009, Zimbabwe and the European Commission signed the Eastern and Southern African (ESA) bloc’s provisional Economic Partnership Agreement (EPA). All exports from ESA nations that have ratified the EPA are eligible for duty-free and quota-free market access. In 2020, Zimbabwe formally became a member of the African Continental Free Trade Area (AfCFTA).

Zimbabwe has a population of 16.8 million, with a GDP (PPP) of US$44.5 billion, and a GDP (PPP) per capita of US$2,000. 2025 GDP growth reached 6%.

Russia has been providing technical assistance and support for Zimbabwe in the nuclear energy sector, with plans to develop a Zimbabwe NPP.

Russia’s bilateral trade with Zimbabwe is worth about US$80 million, with Russian exports including fertilizers, chemical products, transportation and vegetable products. Zimbabwe’s exports include root vegetables, other vegetable products and fruits. Russia’s involvement in training nuclear power engineers will almost certainly mean that Rosatom will be a preferential bidder when contracts to build a NPP in Zimbabwe are tendered.

Tags:

Sergei Shishkarev, chairman of the board of directors at Russia’s Delo Group, has announced the concept of establishing a grain hub in Oman. He stated that “We are looking into establishing a grain transshipment hub, possibly for processing, or to conduct trading operations in the Sultanate of Oman, followed by redistribution and delivery of the grain to African countries.”

Shishkarev said that this primarily concerns the east coast of Africa, where many countries consume Russian grain.

The Delo Group intends to establish a presence in grain elevators and warehouses in grain-consuming areas in Saudi Arabia, the United Arab Emirates, Oman, and possibly Nigeria and Ethiopia as part of its development strategy to 2035.

The Delo Group operates marine container terminals in the Azov-Black Sea, Baltic, and Far Eastern basins; a network of railway container terminals; and a fleet of containers and flatcars. The group’s transportation and logistics division includes the TransContainer intermodal container operator and the Ruscon multimodal transport operator, and the stevedoring division includes DeloPorts and the Global Ports leading container terminal operator.

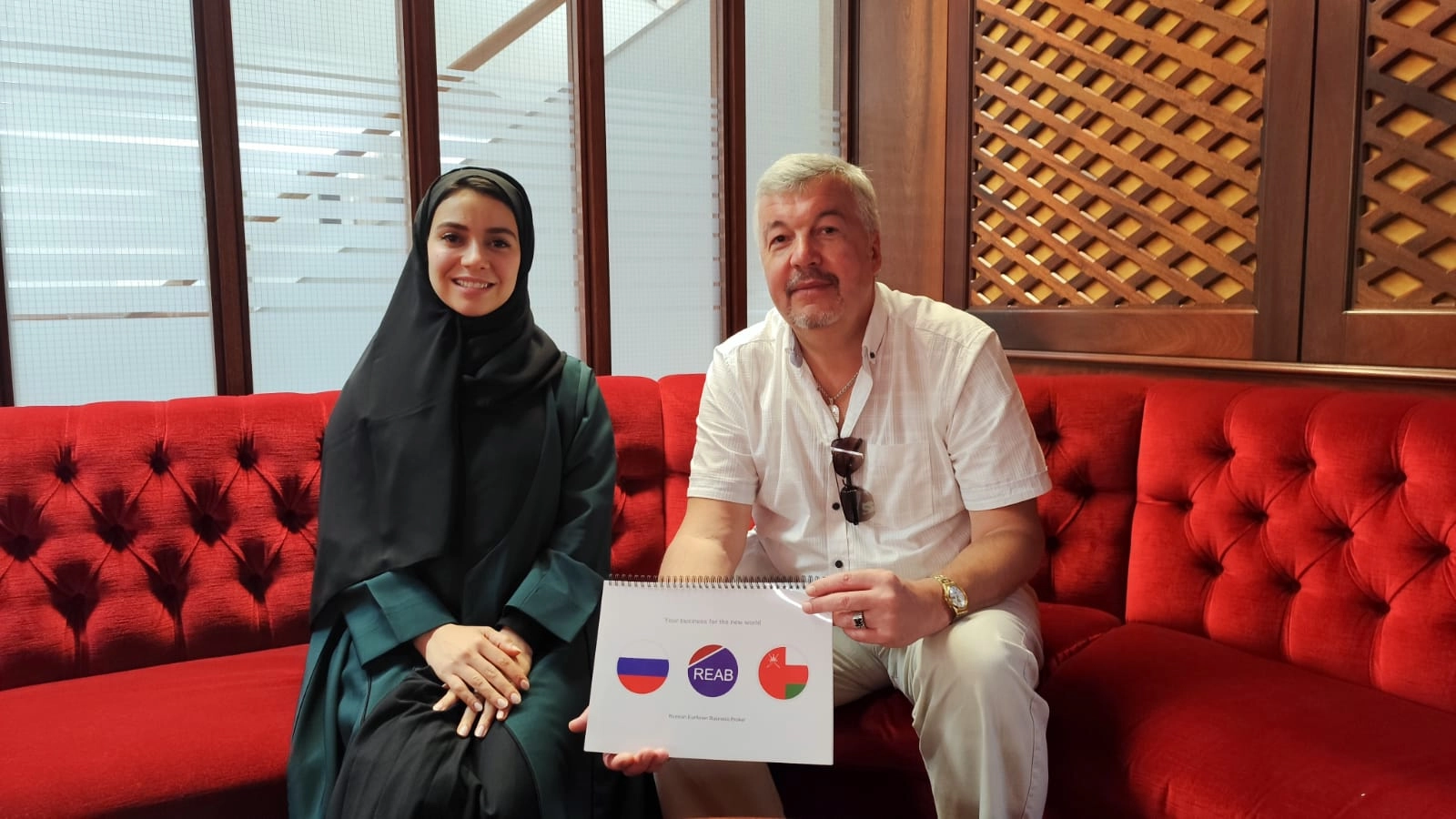

Last week, REAB Consortium Board Member and Marketing Director Ilya Pashchenko concluded his working visit to Oman. As members of the Russian and Ural Chambers of Commerce and Industry, we traditionally begin our work in each new country with an introduction to the national Chamber of Commerce and Industry. Such a meeting took place in Muscat, Oman's capital.

Our representative held initial talks with Ms. Sharouq Hamed Al-Farsi, Section Head of the Foreign Investment Committee. The meeting presented REAB's activities and the consortium's capabilities to support Omani-Russian business cooperation, and discussed support for Russian entrepreneurs launching or acquiring businesses in Oman with REAB's assistance. Given that Russian businesses have long been established in the UAE and are actively working with Qatar, but are just discovering Oman, the parties identified and discussed the great potential for mutually beneficial cooperation between our countries. REAB received approval and support for these initiatives from the Oman Chamber of Commerce and Industry.

Tags:

Dear colleagues, partners, and friends!

We sincerely wish you a Happy New Year! The past year has been challenging, but we look to the future with optimism. Economic and political turbulence prevents us from resting on our laurels, but on the other hand, it brings not only challenges but also new opportunities. Investment capital is on the rise globally, while good investment assets are becoming increasingly scarce. Under these circumstances, professional brokerage is becoming even more in demand. Therefore, we look forward to a busy year ahead, successfully closed deals, new and useful contacts around the world, continued advancement in the Russian and international markets — and the professional satisfaction that comes from quality work.

We wish you all new achievements, success, happiness, peace, health, and prosperity in 2026!

Tags:

In early December’s meeting of the Russia-Uzbekistan Intergovernmental Commission on Economic Cooperation in Tashkent has illustrated that the two countries are rapidly deepening their economic partnership and achieving new historic milestones in trade, investment, and industrial cooperation. Significant capital investments are being made.

Co-chaired by Uzbekistan’s Deputy Prime Minister Jamshid Khodjaev and Russian First Deputy Prime Minister Denis Manturov, Khodjaev announced that the total portfolio of joint investment projects has surpassed US$55 billion. To put that into context, that is about 3.5 times more than the total mutual investments between the United Kingdom and China.

This milestone reflects unprecedented confidence in the long-term strategic trade and investment alignment between the two economies. It marks not only the highest level of bilateral investment cooperation in the modern history of Uzbek-Russian relations but also enshrines the economic partnership as one of the most dynamic in the entire Eurasian region.

According to Khodjaev, Uzbekistan expects to absorb more than US$5 billion in Russian investment by 2026, with US$4 billion already utilized as of late 2025. Manturov, during his working visit to Tashkent, also met with President Shavkat Mirziyoyev and discussed the accelerated implementation of joint projects in key sectors of the economy. His participation in the Russian-Uzbek Business Forum highlighted Moscow’s commitment to deepening pragmatic, sector-focused cooperation. Manturov’s presence signalled that bilateral investments are moving decisively from declarations toward concrete representations, representing nearly 50% of the entire Central Asian population, while structural reforms are aimed at attracting foreign capital.

In this context, Russia has secured its place as one of the primary partners in Uzbekistan’s modernization agenda. This qualitative expansion of human resources creates significant opportunities for Russian companies to trade with and invest in Uzbekistan, as a more skilled and prosperous population drives demand across consumer markets. Developing human capital will also be essential for advancing agro-industrial, technological, and manufacturing cooperation, ensuring that both countries benefit from a stronger, higher-quality workforce. In this regard, the $55 billion portfolio of investment projects serves as a powerful lifeline for the Uzbek economy, driving modernization, industrial growth, and long-term competitiveness.

Khodjaev emphasized that the investment portfolio provides a “solid foundation for new production capacities, employment growth, and increased tax revenues.” Today, over 3,100 Russian-capitalized enterprises operate in Uzbekistan, including 300 new companies launched in the past year, representing nearly 20% of all foreign-owned enterprises in the country. Russian investment in Uzbekistan has already reached about US$4 billion, underscoring steady confidence in the country’s reform-driven growth trajectory. Tashkent is positioning itself as one of Eurasia’s most attractive destinations for long-term Russian capital. This will yield tangible returns in the form of new production facilities, jobs, and tax revenues. On the Russian side, Denis Manturov stressed that the two countries must “ensure the full implementation of the US$55 billion investment package,” underscoring that industrial cooperation has become the central driver of bilateral growth.

Tags:

Russia will cooperate and share its cybersecurity and services digitalization with Bahrain, as well as in the oil and gas industry, according to Russian Minister Olga Lyubimova, the co-chair of the Russian-Bahraini intergovernmental commission on trade, economic, scientific, and technical cooperation.

She was speaking at the 4th meeting of the Russian-Bahraini intergovernmental commission on trade, economic, scientific, and technical cooperation with Bahraini Industry and Commerce Minister Abdulla Fakhro.

Lyubomova said that “We are focusing on cooperation in the pharmaceutical and automotive industries and raised the issue of building systematic work in the area of technologies and equipment for the fuel and energy sector. For our part, we are ready to create all conditions for sharing experience with Bahraini partners in such areas as cybersecurity and digitalization of the service sector, the oil and gas industry, and the educational environment.”

Russia’s Minister of Culture, also mentioned the mutual tourist flow between Russia and Bahrain increased 8% last year.

The Bahraini Industry and Commerce Minister, Abdulla Fakhro, noted the prospects for further active cooperation between Russia and Bahrain in various areas, including industry, tourism, sports, and culture. He said that “we need to focus our efforts on increasing bilateral trade, especially paying attention to investment opportunities in the fuel and energy sector and in the oil and gas industry.”

Bahrain is a dialogue partner state to the Shanghai Cooperation Organisation, and is also in the process of negotiating a Double Tax Treaty with Russia, in addition to a strategic customs agreement, developments that could later lead to a Bahrain-Eurasian Economic Union Free Trade Agreement.

The two countries often coordinate on issues relating to OPEC and global oil supplies, while also looking at positioning Bahrain as a Middle East grain distribution hub as an extension to the INSTC reach into the Gulf.

Current bilateral trade is small at about US$100 million but has been growing at 15% during 2025, illustrating that Russia-Bahrain trade remains a growth development market.

The Eurasian Economic Union (EAEU) and India have held the first round of negotiations on a free trade agreement at the end of November in New Delhi, according to Russia’s Economic Development Ministry.

The EAEU includes Armenia, Belarus, Kazakhstan, Kyrgyzstan and Russia and has a collective GDP (PPP) of about US$8.5 trillion. The EAEU’s GDP per capita (PPP) is approximately US$44,888, with a population of 185.5 million.

India is notoriously difficult when it comes to negotiating trade agreements, as it is highly protective of its own markets. However, this is unlikely to be a major barrier to an agreement with the EAEU as EAEU member states are unlikely to significantly compete with Indian domestic companies in the Indian market. The timing of the negotiations is of note as it provides India with positive news it can present to the Russian President, Vladimir Putin, who visits Delhi later in early December.

The FTA negotiations include resolving issues related to customs administration, as well as applying sanitary and phytosanitary measures and technical regulations in addition to tariff liberalization. Russia and India also addressed competition, intellectual property protection, e-commerce, and the further development of cooperation in various economic sectors.

Russia’s Deputy Economic Development Minister, Vladimir Ilychev said “Russia is interested in expanding trade and economic cooperation with India. It is the world’s largest country by population and Russia’s third-largest trading partner. The agreement should provide preferential access for Russian economic operators to a market with 1.5 billion people, and the elimination of prohibitive tariffs on the Indian market, which can exceed 100%, and should facilitate the diversification of Russian exports.”

The India-EAEU agreement can be expected to be similar to the recent EAEU FTA agreed with Iran. Details of that, which reduced import tariffs on 87% of all traded goods and can be seen here. Since that agreement came into effect, Russia-Iran bilateral trade increased by 35%. A final agreement between India and the EAEU may however be two-three years away, but at least the process has now formally begun.

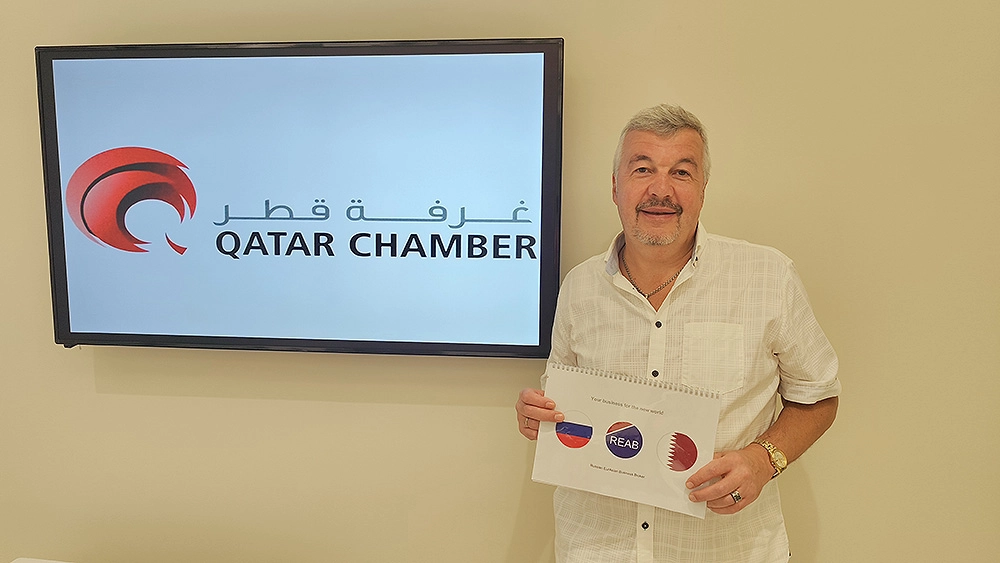

In October 2025, Ilya Pashchenko, a member of the REAB Consortium Board and REAB's representative in the Middle East, visited Qatar. He held a working meeting with a representative of the Qatar Chamber of Commerce and Industry. During the meeting, the parties exchanged their views on the prospects for developing relations between Russian and Qatari businesses and economic cooperation between the two countries in light of Russia's growing business presence in the region. They also discussed practical cooperation between the Consortium and the Chamber in this regard.

A working meeting was also held with a representative of a Qatari investment and consulting company, where they discussed practical issues of supporting Russian businesses in Qatar, including registering and launching new businesses, or acquiring existing ones.

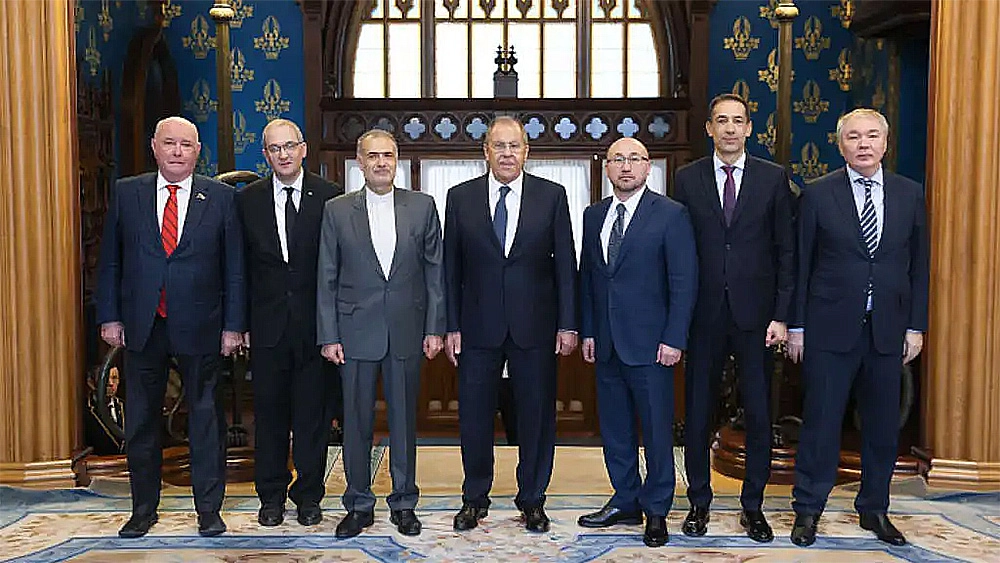

The Russian Foreign Minister Sergey Lavrov held his annual meeting in October with the heads of the four diplomatic missions of the Caspian states. In attendance were Azerbaijani Ambassador Rahman Mustafayev, Iranian Ambassador Kazem Jalali, Kazakh Ambassador Dauren Abayev, and Turkmen Ambassador Esen Aidogdyev.

The meeting was also attended by G.B. Karasin, Chairman of the Federation Council Committee on International Affairs, and L.I. Kalashnikov, Chairman of the State Duma Committee on CIS Affairs and Eurasian Integration.

Discussions included a wide range of issues related to multifaceted cooperation in the Caspian region and deepening interaction within the Caspian framework.

On the same day, a trilateral meeting on cooperation in the fields of transport, energy, and customs was held in Baku. The meeting was attended by Russian Deputy Prime Minister Alexei Overchuk, Azerbaijani Deputy Prime Minister Shahin Mustafayev, and Iranian Minister of Roads and Urban Development Farzaneh Sadeg. As a result, Russia, Azerbaijan, and Iran agreed to set up a working group to develop a plan of action for the development of the North-South international transport corridor by the beginning of next year.

That includes the need to take measures to increase the volume of traffic on the North-South international transport corridor to 15 million tons and ensure continuous growth in freight flows. An agreement was reached to create a working group to prepare an action plan for the implementation of these measures within three months. For comparison, 15 million tons is equivalent to 700,000 to 1 million TEU, or approximately 20% of the total annual TEU transshipment volume in Russia.

The participants confirmed “the importance of continuing efforts to develop the region’s transit potential,” as well as “the significance of accelerating projects aimed at developing and diversifying transport communications and, in this regard, the synchronized implementation of work to expand infrastructure along the INSTC in the relevant territories of the countries.”

An agreement was also reached to establish a special Working Group on Road Transport, consisting of the customs, border, and transport authorities of the three countries.

The signing of the regulation on the trilateral working group on customs cooperation to facilitate transit transport between Azerbaijan, Iran, and Russia. The need to simplify border crossing procedures and digitize transport, border, and customs operations throughout the corridor was emphasized.

An agreement was also reached to continue discussions at the technical level on a project to connect the electrical grids of Azerbaijan, Iran, and Russia, further assisting railway development.

The INSTC links northern Europe with the Gulf and Indian Ocean states via Russia, the Caucasus, and Central Asia. The multimodal corridor was created under an agreement signed by Russia, Iran, and India in 2000, with the number of participants now at 12. The corridor has three main routes:

Western Route: Along the west coast of the Caspian Sea, also servicing markets in Georgia, Armenia and Turkiye with additional rail connectivity to the Black Sea and the European Union;

Eastern Route: Along the east coast of the Caspian Sea, reaching into Central Asia with onward connectivity to China via Kazakhstan;

Trans-Caspian Route: Extending north-south across the Caspian Sea, using Iran as an entry point for further shipments to the Middle East, Pakistan, India, and Southeast Asia.

Tags:

The Russian Agroexport federal center has said that Russia aims to increase grain exports, primarily wheat, to Indonesia, and the free trade agreement between the Eurasian Economic Union (EAEU) and Indonesia, which will be signed at the end of 2025, will open up significant opportunities for this.

According to Agroexport, this year Russia exported around 123,000 tonnes of grain to Indonesia, worth US$29 million, although shipments ceased in January. However, Indonesia has now extended the accreditation of testing laboratories subordinate to Agroexport in August, making it possible to resume exports. In October, 52,000 tonnes of wheat were shipped.

Currently, wheat, soybeans, corn (including corn flour), and barley from Russia are approved for export to the Indonesian market. According to Agroexport, Russian grain exports to Indonesia for 2024 exceeded 1.3 million tonnes, valued at over US$310 million.

When the free trade agreement between the EAEU and Indonesia comes into force, a preferential tariff regime will be applied for grain exports from Russia, including a reduction of the duty on wheat from 5% to zero by one percentage point per year from the start of the agreement, Agroexport said, adding, “This is an important agreement for Russian suppliers, since Indonesia is the largest grain importer in Southeast Asia. Obtaining a zero duty when exporting wheat to the Indonesian market would be a great support.”

The complete FTA will see 93% of all bilaterally traded goods between Russia and Indonesia be reduced to zero.

Russia-Indonesia bilateral trade has been increasing and rose from US$3.3 billion in 2021 to US$4 billion in 2024. Russian tourism to the country is increasing, while several Russian manufacturers, including Kamaz, are operational in Indonesia. Another example is Softline, a prominent, Moscow-based, publicly traded IT developer, which has opened a new office in Indonesia to promote its products and services, in addition to providing vendor solutions. It sees its expert knowledge as a good match for the development potential in Indonesia, which has one of Southeast Asia’s largest online consumer markets.

The overall bilateral trade dynamics are highly positive, and especially so with the EAEU Free Trade Agreement coming into effect. Businesses from within Russia and the EAEU should be conducting market research activities to establish what products can be sold to this important consumer market.

A business mission to Indonesia by the Russian Union of Grain Exporters begins on October 17, during which “cooperation between Russia and Indonesia will be discussed, primarily on increasing supplies of grain and pulses.”

Tags:

At the end of October, a meeting was held between Ilya Pashchenko, a member of the REAB Consortium's board of directors and REAB's representative in Turkiye and the Middle East, and Mr. Şafak Yıldız, head of the consulting and legal firm Turk Adviser. The meeting was organized with the support of Vladimir Emmer, a representative of the Chamber of Commerce and Industry of the Russian Federation in Turkiye. The company provides consulting, legal, accounting, auditing, customs, and other support to international companies starting businesses in Turkiye.

The parties shared their views on the current state of Russian-Turkish economic relations, discussed possible areas of cooperation, presented the market opportunities of Turk Adviser and REAB, and identified specific working formats for the implementation of joint Turkish-Russian economic projects.

We express our sincere gratitude to all the organizers and participants of this meeting for the fruitful dialogue and hope that it will develop into a full-fledged partnership.

New artıcles

New artıcles

Useful tip

Useful tip