Free economic zones in Uzbekistan

Table of contents

Table of contents

The creation and development of free economic zones in the Republic of Uzbekistan is quite a priority. The country's government is actively involved in supporting programs to improve the business environment and investment climate in Uzbekistan.

Free economic zones are one of the factors of state regulation of the economy by providing preferential treatment to businesses in order to attract foreign investment, expand export potential, introduce modern technologies into production, which ultimately leads to the development of the national economy and improving the efficiency of its integration into the world economy .

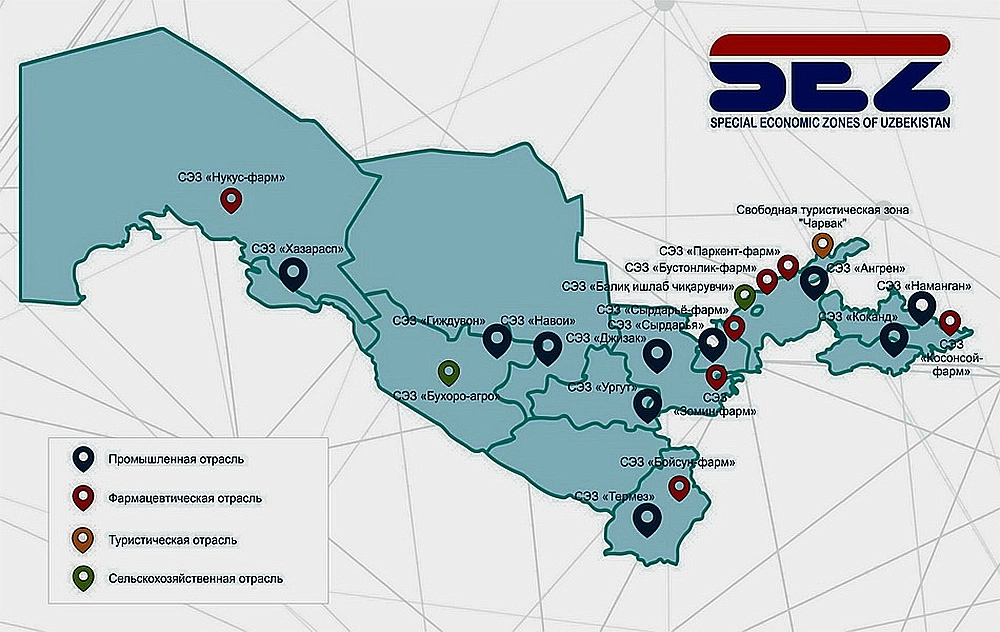

List of free economic zones of Uzbekistan

- «Navoi» SEZ

- «Angren» SEZ

- «Jizzakh» SEZ

- «Urgut» SEZ

- «Gijduvan» SEZ

- «Kokand» SEZ

- «Namangan» SEZ

- «Khazarasp» SEZ

- «Termiz» SEZ

- «Nukus-farm» SEZ

- «Zomin-farm» SEZ

- «Kosonsoy-farm» SEZ

- «Sirdaryo-farm» SEZ

- «Boysun-farm» SEZ

- «Bustonlik-farm» SEZ

- «Parkent-farm» SEZ

- «Andijon-farm» SEZ

- «Charvak» STZ

- «Balik ishlab chikaruvchi» SEZ

- «Sirdaryo» SEZ

- «Bukhoro-agro» SEZ

- «Chirokchi» SEZ

Benefits and preferences in the territory of free economic zones

In accordance with the Decree of the President of the Republic of Uzbekistan dated October 26, 2016. No. UP-4853, enterprises participating in free economic zones (hereinafter - SEZ) are exempt from paying:

- land tax, income tax, property tax of legal entities, tax on improvement and development of social infrastructure, single tax payment for micro-firms and small enterprises, as well as mandatory contributions to the Republican Road Fund and the extra-budgetary Fund for Reconstruction, Major Repairs and Equipment secondary schools, vocational colleges, academic lyceums and medical institutions under the Ministry of Finance of the Republic of Uzbekistan;

- customs payments (except for customs clearance fees) for equipment, raw materials, materials and components imported for own production needs, with the targeted direction of the released funds for the creation of new ones, as well as for modernization, reconstruction and technical, technological re-equipment, expansion existing production facilities, construction of industrial buildings, acquisition of raw materials and materials necessary for own production needs, without the right to return a negative amount of value added tax arising when exporting products;

- customs payments (except for customs clearance fees) for construction materials not produced in the republic and imported as part of the implementation of projects, in the presence of a positive conclusion from the State Unitary Enterprise “Center for Comprehensive Expertise of Projects and Import Contracts” under the Ministry of Economy and Industry of the Republic of Uzbekistan based on the results of a comprehensive examination of lists of goods.

Benefits in the SEZ are provided for a period of 3 to 10 years, depending on the volume of investments made, including the equivalent (US dollar):

- from 300 thousand dollars to 3 million dollars — for a period of 3 years;

- from 3 million dollars to 5 million dollars — for a period of 5 years;

- from 5 million dollars to 10 million dollars — for a period of 7 years;

- from 10 million dollars and above — for a period of 10 years, with the application over the next 5 years of an income tax rate and a single tax payment in the amount of 50% lower than the current rates.

Enterprises participating in the FEZ are exempt for the entire period of operation of the free economic zones from paying customs duties (except for customs clearance fees) on imported raw materials, materials and components in relation to products sent for export.

The state ensures guaranteed connection of enterprises participating in the FEZ to engineering and communication networks with timely connection to production sites and their uninterrupted functioning.

Procedure for consideration and approval of investment projects in the territory of free economic zones

- The selection of investment projects for placement in the FEZ is carried out in accordance with the Regulations on the procedure for selecting investment projects for placement in the territory of the FEZ and registration of FEZ participants (hereinafter referred to as the Regulations), approved by the resolution of the Cabinet of Ministers dated 01/16/2018. No. 29.

- The decision by administrative councils to implement a project on the territory of free economic zones is carried out only if there is a positive conclusion from the State Unitary Enterprise “Center for Comprehensive Expertise and Import Contracts under the Ministry of Economy and Industry of the Republic of Uzbekistan” (hereinafter referred to as — Center) on business plans or feasibility studies of ongoing projects.

- The period for issuing the Center’s conclusion on business plans or feasibility studies of implemented projects should not exceed twenty calendar days, The total period for consideration by administrative councils of investment applications for the location of production facilities on the territory of free economic zones should not exceed thirty calendar days, including the process of issuing the Center’s conclusion, in accordance with with the Decree of the President of the Republic of Uzbekistan » On measures to further improve the system of coordination and management of the activities of free economic zones dated December 21, 2018. No. UP- 5600.

The investor submits to the FEZ Directorate a completed investment application for locating production on the territory of the FEZ with the following attached:

- information about the state registration of a legal entity (investor) or other document confirming the activities of this investor;

- business plan of the proposed investment project;

- information confirming the investor’s experience in the relevant field and/or implementation of similar investment projects (if any);

- information about the investor’s financial and economic activities over the past three years.

All documents are submitted by the investor to the Directorate accompanied by a duly certified translation into the state or Russian language. The investor is responsible for the accuracy of the information and documents provided.

The Administrative Council reviews the submitted investment applications and business plans and, based on the results, makes a decision on the possibility of implementing the project in the territory of the FEZ or the need to finalize the submitted documents or the inappropriateness of implementing the investment project in the territory of the FEZ.

The business plan submitted to the Directorate must reflect the following basic information:

- information about the organization of the legal entity (hereinafter referred to as the applicant) or its founders, their experience in the relevant field and in the implementation of a similar investment project;

- the number of jobs created, indicating the sources of recruitment (local - college graduates, persons sent by the labor exchange, employees of other organizations and attracting specialists from abroad);

- name, specifics and volumes of products planned for release;

- expected prices and sales markets for manufactured products, indicating volumes of supplies to domestic and foreign markets;

- marketing research of domestic and foreign markets for products planned for release;

- availability of a raw material base and a guaranteed possibility of providing raw materials and materials for the period of implementation of the investment project, with a separate indication of local and imported materials and components;

- calculation of the level of localization of production and changes in the commodity position of the final product according to the code of the commodity nomenclature of foreign economic activity of the Republic of Uzbekistan (code according to the Commodity Nomenclature of Foreign Economic Activity, version 2017) in comparison with the source raw materials at the level of one of the first 4 digits;

- logistics and transportation of resources and finished products necessary for production;

- necessary volumes and parameters of engineering and communications support facilities (electricity, natural gas, drinking and process water, sewerage, roads) for the implementation of the investment project and the stable functioning of production;

- presence of industrial emissions, indicating the types and volumes of gases, solid and liquid waste;

- estimated size of the required area for rational placement of production;

- preliminary production layout indicating the location of the main production workshop, equipment and production line, administrative building, warehouse and other auxiliary premises;

- description of production technology (taking into account environmental requirements) with a list of technological equipment, manufacturers, suppliers and countries;

- characteristics of the technological equipment intended for use in production, as well as the management system used in the investment project that meets international standards;

- expected volumes, type and timing of investments, sources of financing and expected collateral in case of borrowing;

- financial and economic calculations and indicators of economic efficiency of the implementation of an investment project.

The Directorate, within 2 working days, reviews the submitted investment application and the documents attached to it for compliance with the requirements of paragraphs 6 and 7 of the Regulations of the Cabinet of Ministers Resolution dated January 16, 2018. No. 29.

Investment applications submitted in violation of the requirements of paragraphs 6 and 7 of the Regulations of the Resolution of the Cabinet of Ministers dated January 16, 2018. No. 29, are returned to the investor without consideration, indicating the identified deficiencies.

Other topics:

Other topics:

REAB Services

REAB Services

News

News

Useful tip

Useful tip