Free trade zones in Malaysia

Table of contents

Table of contents

There are many advantages for businessmen to open a company in Malaysia. In addition, the presence of free trade zones makes the country more attractive to investors who want to do business here.

The country is actively involved in the formation and operation of SEZs on a joint basis with other countries (Singapore, Indonesia, Thailand, Brunei, the Philippines, China) as zones of cross-border cooperation. Also, the Malaysian state of Labuan is one of the well-known offshore zones with offshore legislation and a fairly broad specialization for offshore business.

Malaysia's special economic zones are attractive due to incentives such as tax incentives, developed infrastructure, a business-friendly regulatory environment, focus on specific industries and improved access to markets, backed by strong government support.

Malaysia's economic corridors offer a range of fiscal incentives, primarily in the form of tax breaks, some of which are tailored to each specific corridor. In addition, these corridors provide sectoral incentives such as incentives for manufacturing, tourism and energy. These incentives, coupled with their well-integrated infrastructure, make economic corridors key hubs for growth and development in Malaysia.

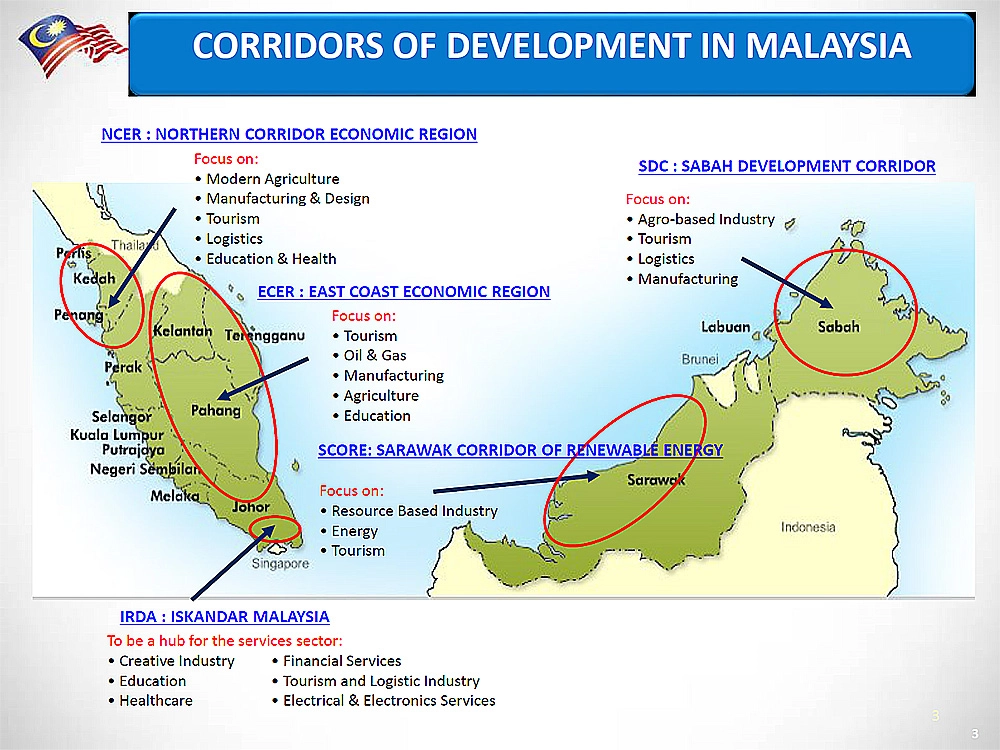

There are currently several investment corridors (new type of SEZ) operating in Malaysia: the East Coast Economic Region (ECER), the Iskandar Regional Development Authority (IRDA) for Iskandar, Malaysia in southern Johor, and the Northern Corridor Implementation Authority (NCIA) for the Northern Corridor Economic Region (NCER).

Malaysia’s existing development corridors focus on the following sectors:

- East Coast Economic Region: tourism, oil and gas, manufacturing, agriculture, and education.

- Sabah Development Corridor: agro-industry, tourism, logistics, and manufacturing.

- Sarawak Renewable Energy Corridor: resource-based industry, power, tourism

- Northern Corridor Economic Region: modern agriculture, manufacturing and design, tourism, logistics, education and healthcare.

Johor (JS-SEZ)

Singapore and Malaysia are teaming up to establish a special economic zone (SEZ) in the Malaysian state of Johor (JS-SEZ), adjacent to the border with Singapore. The joint effort aims to strengthen business ties and improve connectivity between the two countries as the region grapples with the global economic downturn. A memorandum of understanding was signed by the two leaders on January 11, with a full agreement expected to be signed in late 2024.

The planned SEZ aims to improve the movement of goods and people across the Johor-Singapore Causeway, as well as strengthen the shared Iskandar Malaysia-Singapore ecosystem. Established in 2006, Iskandar Malaysia is the main southern development corridor in Johor.

The Johor-Singapore Special Economic Zone will be established in the Iskandar region of Malaysia (formerly the Iskandar Development Region and the Southern Johor Economic Region), with the government actively promoting it as an attractive investment destination aimed at supporting the electronics, healthcare, financial services and business-related services industries.

Singapore and Malaysia have begun construction of a light rail link connecting Singapore and Johor Bahru. The railway is expected to achieve a capacity of 10,000 passengers per hour and will significantly reduce congestion on the current Johor-Singapore Causeway, one of the busiest land crossings in the world. The US$2.2 billion project is expected to be completed in 2026.

The leaders of both countries mentioned that there will be special tax incentives as well as bonded warehouses. In addition, both governments are exploring the possibility of passport-free travel between the two countries under the JS-SEZ. This will be facilitated through a QR code-based clearance system at checkpoints on both borders.

East Coast Economic Region (ECER)

Incentives for Manufacturing Activities

The ECER offers income tax exemptions of between 70% and 100% for 10 or 15 years, starting from when a company earns statutory income for selected manufacturing services. There is also an investment tax relief equivalent to 100% of total expenditure for 5 years in addition to a stamp duty exemption on land or buildings acquired for approved activities.

Incentives for activities in the oil, gas and petrochemical industries

ECER offers income tax relief of between 70% and 100% for 10 or 15 years, starting from the time the company earns statutory income from selected oil, gas and petrochemical activities. There is also an investment tax relief equivalent to 100% of total expenditure for 5 years in addition to a stamp duty exemption on land or buildings acquired for approved activities.

Incentives for Tourism Activities

ECER offers a 70% to 100% income tax exemption for 10 or 15 years, starting from the date a company earns statutory income from the following tourism activities:

- Island tourism;

- Ecotourism;

- Medical tourism;

- Theme and amusement parks;

- Mainland coastal tourism;

- Integrated resorts;

- Cultural and exhibition centers.

There is also an investment tax exemption of 100% of the total expenditure for 5 years, in addition to a stamp duty exemption for land or buildings purchased for an approved activities.

Incentives for activities related to agriculture

As with the previous activities, there is an income tax exemption of 70 to 100% for 10 or 15 years, starting from the moment the company receives the statutory income from selected activities related to agriculture. These are:

- Growing kenaf, vegetables, fruits, herbs, spices or cocoa;

- Raising cattle, buffalo, goats, sheep, ostriches, turkeys or quails;

- Aquaculture;

- Growing crops for energy;

- Inland or deep-sea fisheries;

- Floriculture, including ornamental flowers.

There is also an investment tax exemption of 100% of the total expenditure for 5 years, in addition to an exemption from stamp duty on land or buildings acquired for approved activities.

Promotion of education and ICT activities

Investors who establish universities, services, ICT-related businesses, training centres, colleges and service centres can benefit from income tax exemptions ranging from 70% to 100% for 10 or 15 years, starting from the time the company earns the statutory income. There is also an investment tax credit equivalent to 100% of the total expenditure for 5 years in addition to a stamp duty exemption on land or buildings acquired for approved activities.

Northern Corridor Economic Region (NCER)

Businesses investing in NCER priority sectors can claim the following incentives:

- Income tax exemption of up to 100% for up to 15 years;

- Income tax exemption of up to 100% for 10 years;

- Reduction in stamp duty on land lease by 50%;

- Exemption from import duties on import of raw materials, machinery, spare parts and equipment.

Priority sectors in NCER are:

- Manufacturing;

- Agriculture and Bio-Industry;

- Tourism;

- Logistics;

- Medical Science.

Iskandar Malaysia

Iskandar Malaysia is based on nine promoted sectors. These are:

- Healthcare;

- Creative Industries;

- Electrics and Electronics;

- Petrochemicals and Oleochemicals;

- Logistics;

- Financial and Business Services;

- Education;

- Tourism;

- Food and Agro-processing.

Investors involved in the above activities in Iskandar, Malaysia can enjoy:

- 100% tax exemption on statutory income for up to 10 years

- 200% tax deduction for up to 10 years on investment activities.

Company Incentives in Medini

Medini Iskandar Malaysia (MIM) is a mixed-use development in the Iskandar Malaysia Economic Corridor. MIM is home to Legoland Malaysia, residential and office buildings, shopping malls and eco-parks. Approved developers in MIM can receive an income tax exemption on statutory income earned from the rental or sale of a building located in an approved area in MIM until 2025. In addition, approved development managers (companies that provide management, supervision or marketing services to MIM) can get income tax exemption until 2024.

Digital Free Trade Zone in Malaysia

Not only does Malaysia offer free trade zones such as Pasir Gudang (manufacturing), Port Klang (logistics) or Bayan Lepas (manufacturing), but the country also has a Digital Free Trade Zone (DFTZ).

The Digital Free Trade Zone is a strategic national initiative led by the Malaysia Digital Economy Corporation (MDEC) to enable seamless cross-border trade through digitalization and facilitate local SMEs’ access to vast opportunities in global markets through e-commerce.

The objective of the Digital Free Trade Zone is to enhance Malaysia’s participation in cross-border e-commerce. It focuses on promoting exports for local SMEs by leveraging digital technology and e-commerce capabilities, as well as attracting investment to establish regional e-commerce fulfillment hubs in Malaysia.

Benefits of Free Trade Zones in Malaysia

1. Deferral, reduction and waiver of certain types of duties.

The Free Trade Zones in Malaysia have deferred most of the duties of any type of customs program. This makes it easier for companies to import goods into the free trade zones without incurring duties and levies. This also includes exemption from inventory tax.

2. Exemption from re-export duties.

Free Trade Zones are considered to be the trading limits of Malaysia. Therefore, a company importing components or raw materials into the free trade zones will not be required to pay customs duty until it enters the recipient country.

3. Exemption from duty on scrap, defects and crop losses.

Since a manufacturer operating in free trade zones does not pay import duties until the goods leave the free trade zones, they essentially pay duties on the raw materials after they have been processed.

4. Improved compliance, inventory tracking and quality control.

Free Trade Zones in Malaysia allow companies to work closely together to track their inventory. By delivering goods to a company-owned free trade zone warehouse, the company can identify and classify the goods in the warehouse rather than at the port.

5. Indefinite Storage.

A company can store its goods in a free trade zone indefinitely until the port opens or quotas for the goods are available.

6. Elimination of Customs Duties when Moving Between Zones.

Free trade zones in Malaysia can be used to manage transhipment operations, saving money on handling charges. While companies in Malaysia focus on using these zones for export purposes, they can also be used for cross-docking and moving goods from one free trade zone to another without having to pay customs duties.

Disadvantages of Free Trade Zones in Malaysia

While there are many advantages to using free trade zones in Malaysia, there are also disadvantages to consider:

- Comprehensive rules and regulations to comply with.

- The Customs Department may conduct regulatory checks when it deems appropriate.

- High paid-up capital requirements depending on the type of business the company wishes to undertake.

- Special permits and licenses are required and can be quite time-consuming to obtain.

- Must have a physical office in the free trade zones (increasing operating costs in the annual financial statement).

Other topics:

Other topics:

REAB Services

REAB Services

News

News

Useful tip

Useful tip