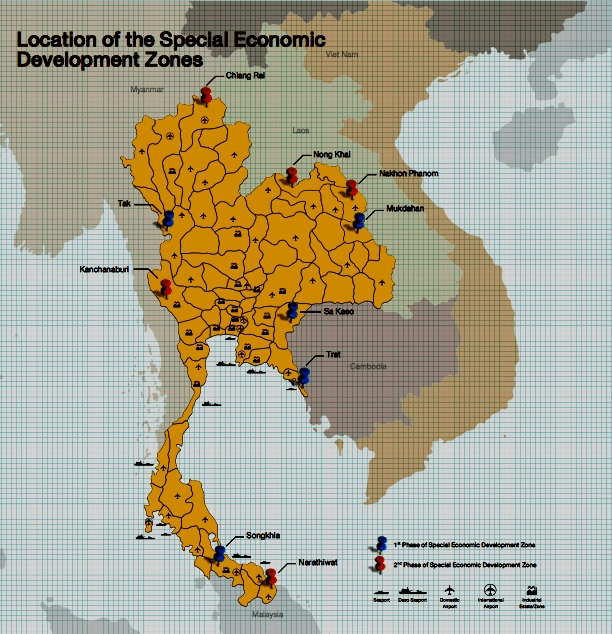

Special economic zones in Thailand

With a steadily growing population and expanding global exports, Thailand's economy offers lucrative opportunities for investors seeking dynamic markets with the potential for significant returns.

2024/11/11

88