Special economic zones in Thailand

Table of contents

Table of contents

With a steadily growing population and expanding global exports, Thailand's economy offers lucrative opportunities for investors seeking dynamic markets with the potential for significant returns.

Thailand's Special Economic Zones (SEZs) are regions newly designated by the Special Economic Zones Development Board of the Thai government. The establishment of SEZs along Thailand's border regions was an idea put forward by the Asian Development Bank in 1998 as a strategy to promote the use of cross-border economic corridors. This led to Thailand's formulation of the Border Economy Development Action Plans to transform existing transport corridors in the region into true economic corridors.

In 2013, the Royal Cabinet of Thailand commissioned a study to examine the feasibility of establishing SEZs in Thailand, following which the National Council for Peace and Order announced a new policy on Special Economic Development Zones to link border cities with other cities in the ASEAN community. Thus, the establishment of 10 SEZs in two phases was announced.

Foreign Trade Zones

The Industrial Estate Authority of Thailand (IEAT), a state-owned enterprise under the Ministry of Industry, develops suitable locations for industrial facilities. The IEAT has an established network of industrial zones in Thailand, including the Laem Chabang Industrial Zone in Chonburi Province and the Map Ta Phut Industrial Zone in Rayong Province in Thailand's eastern coastal region, a common location for foreign factories due to its proximity to seaports and Bangkok. Foreign companies generally have the same investment opportunities in industrial zones as Thai businesses. Although the IEAT is required to review and approve the amount of space/land purchased or leased by foreign companies in industrial zones, there is no record of any land requests being rejected. Private developers are actively involved in the development of these zones.

Currently, IEAT manages 15 estates, plus another 50 jointly with the private sector, in 16 provinces across the country. Private developers independently manage more than 50 industrial estates, most of which have received promotion privileges from the BOI. Amata Industrial Estate and WHA Industrial Development are the leading private developers of industrial estates in Thailand. Most of the major foreign investors in manufacturing are located in the industrial estates of these two companies and in the east coast region.

Free Trade Zones

Thailand's free trade zones (FTZs) come in two main types - general industrial zones or "industrial complexes" and special economic zones (SEZs), usually located along Thailand's borders. IEAT has established 12 special IEAT "FTZs" reserved for industries producing exclusively for export. Businesses can import raw materials into these zones and export finished products from them duty-free (including value-added tax). These zones are located in industrial complexes, and many have customs exemptions to speed up processing. In addition to these zones, factory owners can apply for permission to establish a bonded warehouse on their premises, into which raw materials used solely for the manufacture of products for export can be imported duty-free.

The Customs Act also allows the Director General of Customs to issue permits to companies to establish “free zones” for industries and sectors deemed beneficial to the country. Imports and exports of goods through free zones are exempt from customs duties, and import duties are also waived for machinery, equipment, tools, instruments and components necessary for the operation of a business or the assembly, installation or operation of equipment. To date, free zones have been established at Don Mueang Airport, Suvarnabhumi Airport, U-Tapao Airport, the Special Economic Development Zone and the Eastern Economic Corridor.

Eastern Economic Corridor (EEC)

Thailand's flagship investment zone, the Eastern Economic Corridor (EEC), covers the provinces of Chachoengsao, Chonburi and Rayong (5,129 square miles) and includes no fewer than 22 industrial zones. The EEC leverages the advanced infrastructure networks of the adjacent East Coastal Industrial Zone, a major investment destination for Thailand for over 30 years. The Thai government's goal is to develop the EEC as a major investment and infrastructure hub in ASEAN and a gateway to East and South Asia. Planned development projects for the EEC include smart cities; innovation district (EECi); digital park (EECd); aerotropolis (EEC-A); medical center (EECmd) and high-speed rail belt network (EECh). EEC targets twelve industries:

- Next-generation automobiles

- Smart electronics

- Advanced agriculture and biotechnology

- Food industry

- Tourism

- Advanced robotics and automation

- Integrated aviation industry

- Medical center and full range of healthcare services

- Biofuels and biochemicals

- Digital technologies

- Defense industry

- Human resource development

Key investments were made in the following industries and projects:

- Motorway project (US$2 billion)

- High-speed train (US$2.5 billion)

- Double-track railway (US$2.2 billion)

- U-Tapao airport expansion (US$7.1 million)

- Laem Chabang deep-water port (US$1.1 billion)

- Expansion Ta Phut Deep Sea Port ($350 million)

The EEC Act allows investment incentives and privileges. Investors can obtain long-term land leases of up to 99 years (with an initial lease of up to 50 years and an option to extend up to 49 years). The EEC Act shortens the approval process for public-private partnerships to approximately nine months.

The BOI works in collaboration with the EEC Office. The BOI offers corporate income tax exemptions of up to 13 years for strategic projects in the EEC region. Foreign executives and experts working in targeted industries in the EEC are subject to personal income tax at a maximum rate of 15-17%.

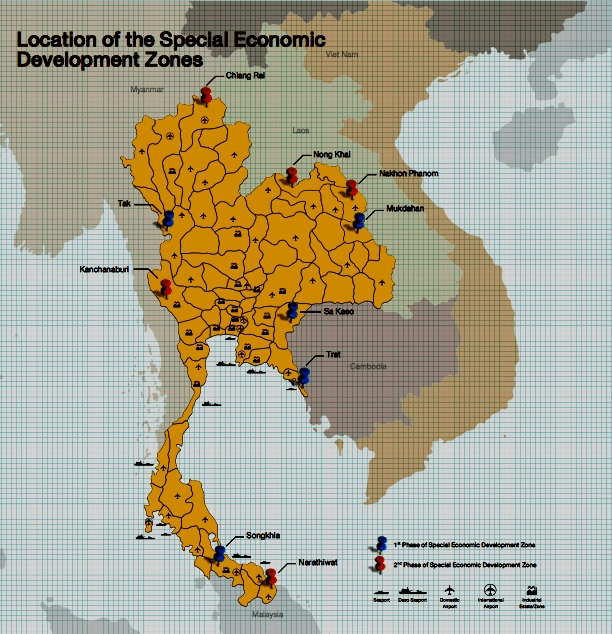

Special Economic Zones in Thailand

There are currently 10 Special Economic Zones (SEZs) in Thailand, located in the provinces of Chiang Rai, Narathiwat, Tak, Nong Khai, Trat, Kanchanaburi, Mukdahan, Songkhla, Sa Kaeo and Nakhon Phanom.

These SEZs support the Thai government's goals of closer economic ties with neighboring countries and allow investors to take advantage of the country's abundant migrant labor force; However, these SEZs have proven less attractive to foreign investors due to their remote locations away from Bangkok and other major cities.

Tak Province

Tak Province is a special economic development zone with 14 sub-districts. Strategically located on the East-West Economic Corridor (EWEC), the western region of Tak facilitates the transportation of goods and resources from the free trade zone to Yangon, the economic hub of Myanmar. Mae Sot Airport is an international airport located in Tak Province, which is connected to two domestic airports.

Sa Kaeo Province

Sa Kaeo Special Economic Zone is located on the Southern Economic Corridor (GMS), which is an important route for transporting products from Thailand to Phanom Penh and southern Vietnam. The SEZ can benefit from joint production with the Poipet O'Niang Special Economic Development Zone in Cambodia, as many Thai enterprises have labor-intensive factories in the Cambodian Free Zone.

Trat Province

Known as a popular tourist destination, Trat Province is an attractive free trade zone for enterprises looking to set up operations in the tourism and service sectors. The free trade zone is also linked to the Koh Kong Special Economic Development Zone in Cambodia. The city has 1 commercial airport and is also connected by road to the Laem Chabang Seaport and Sihanoukville Seaport in Cambodia.

Mukdahan Province

Located on the East-West Economic Corridor, (EWEC), the SEZ links Thailand with nearby Asian countries such as Japan, South Korea and Taiwan. The SEZ is an important route for transporting goods and raw materials to Vietnam and South China.

Songkhla Province

Created in the Indonesia-Malaysia-Thailand (IMT-GT) Growth Triangle, Songkhla Special Economic Development Zone is located close to the Penang Seaport, Klang Seaport in Malaysia and the railway connecting Thailand with Malaysia. In addition, the province operates a joint Special Economic Development Zone with Sadao and Bukit Kai Hitam in Malaysia, providing a wider range of investment opportunities in the manufacturing and service sectors and encouraging investment from Malaysia. The Zone hosts many manufacturing networks linked to Malaysia, facilitating the transport of rubber, seafood, and electronics between the two countries.

Chiang Rai Province

The Chiang Rai Special Economic Zone is connected to Yunnan Province in southern China by both land and sea, allowing for more efficient trade between the two countries. With its high-quality logistics services and popularity among tourists, Chiang Rai Province is a popular choice for business owners looking to set up shop in Thailand.

Nong Khai Province

The province is a conduit for border trade between Thailand and Laos. With the completion of the FTZ in Laos, goods can be more easily transported between the FTZs. The FTZ has a well-integrated transportation network, including facilities that facilitate travel by road, rail and air.

Nakhon Phanom Province

The FTZ is a trade route through Vietnam and South China (Guangxi), which facilitates efficient and timely delivery of products to distant eastern countries such as Japan, Korea, Hong Kong and Taiwan.

Kanchanaburi Province

The province is connected to the Myanmar Special Economic Development Zone and the east coast of Thailand.

Narathiwat Province

The province is connected to Malaysia via Asian Highway 18, which also connects to Singapore. The province is known as a trading port for fishery products, timber products, consumer goods and other products. It mainly exports boats and other consumer goods.

Business Incentives

Thailand Free Trade Zone Tax Incentives

- Companies registered in a target industry in a Thai FTZ are exempt from corporate income tax for the first eight years. After that, they will receive an additional 50% corporate income tax deduction for 5 years.

- Imported goods necessary for the operation of companies in the Thai Free Zone are exempt from import duties, VAT, excise tax and alcohol tax, if applicable.

- Imported goods eligible for exemption include machinery and equipment, foreign products and goods transferred from other free zones.

- Domestic goods transferred to the FTZ are exempt from VAT.

Export Promotion

- Imported goods or domestic raw materials transferred to the FTZ for business activities are exempt from standard quality control requirements and any other similar requirements if the final product is re-exported to other countries.

- Generally, the Thai Free Zone does not impose import tax or domestic taxes and duties on scrap, waste and productivity losses from imported components.

Access to Skilled Labor in Thailand's Free Trade Zones

- Since many multinational corporations are located in Thailand's free trade zones, when multinational corporations hire local employees, there will be a transfer of management or technical skills to local employees in Thailand.

- Many multinational corporations are also willing to invest in vocational training programs to enhance the skills of their local employees.

Provision of Supporting Infrastructure in Thailand's Free Trade Zones

Many free trade zones have a well-integrated transportation and communication network to support activities in the region. They also offer warehousing, distribution and other facilities to support export and import activities.

Thai Customs has implemented various measures to improve trade and customs processing:

- Pre-processing (PAP);

- e-Bill Payment;

- e-Customs system,

- National Single Window (NSW), which reduces paper use and improves service delivery in the customs process.

The measures are consistent with the World Trade Organization (WTO) Trade Facilitation Agreement (TFA), which requires WTO members to adopt pre-processing procedures for imports and allow electronic filing of customs documents where appropriate.

NSW was also developed in conjunction with the ASEAN Single Window, which is a regional initiative that will connect and integrate the NSWs of ASEAN member states to expedite customs clearance of goods and facilitate the electronic exchange of documents related to cross-border trade.

Other topics:

Other topics:

REAB Services

REAB Services

News

News

Useful tip

Useful tip