Copper mining business with a SX-EW plant in Kazakhstan

Currency:

₽

Armenian dram (֏)

Azerbaijani manat (₼)

Belarusian ruble (Br)

Brazilian real (R$)

Chinese yuan (¥)

Egyptian pound (LE)

Euro (€)

Georgian lari (₾)

Indian rupee (₹)

Indonesian rupiah (Rp)

Iranian rial (IR)

Kazakhstani tenge (₸)

Kyrgyzstani som (с)

Qatari rial (QR)

Russian ruble (₽)

Serbian dinar (din)

South African rand (R)

Tajik somoni (с.)

Turkish lira (₺)

UAE Dirham (Dh)

US Dollar ($)

Uzbek sum (сўм)

Vietnamese dong (₫)

Revenue (year)

No data

Profit (year)

No data

Payback (mon.)

Description

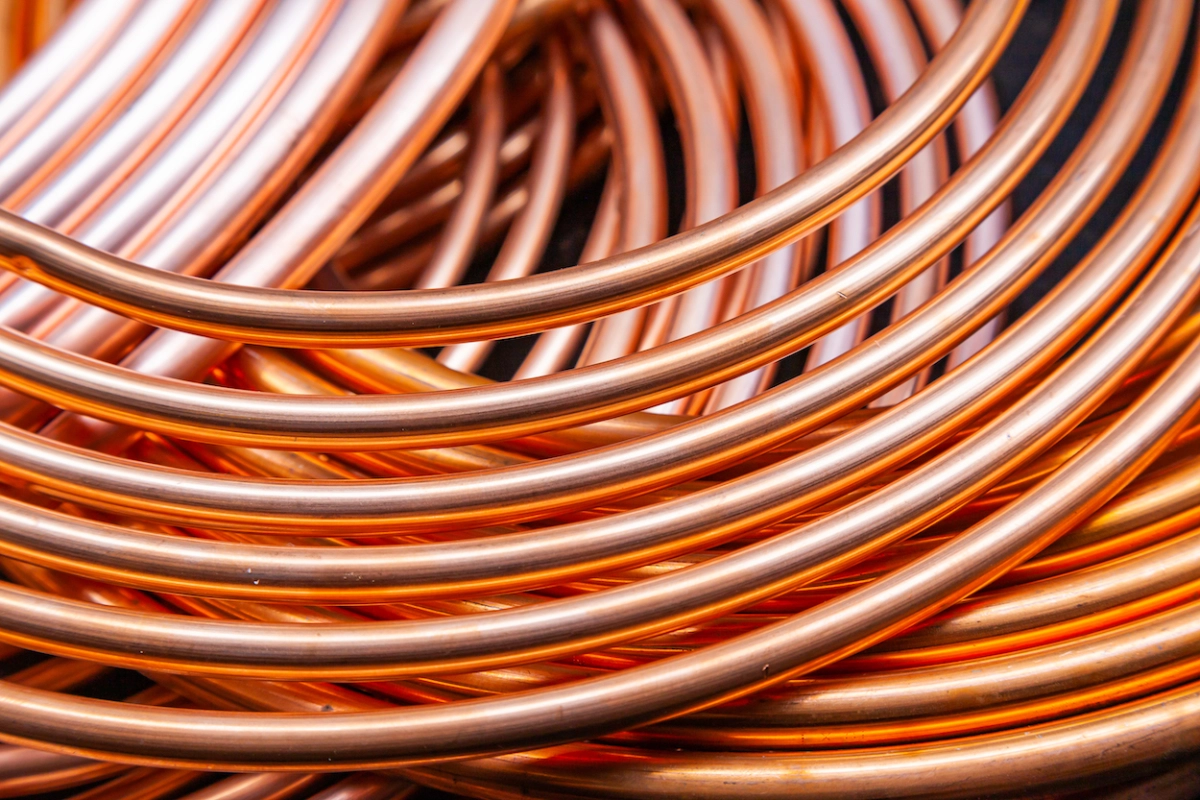

Copper Mining Business with a SX-EW plant (JORC certified) in Kazakhstan is for sale.

This deposit has been key feeder for the giant Balkhash smelter, responsible for 65% of Kazakhstan’s copper production. Dumps of over 300 mln ton accumulated from 40 years of operation.

Resource analysis

- Wardell Armstrong (MRI, PCR) 2020

During 2015-2016 the company undertook exploration:

- Reverse circulation (RC) drilling – 47 holes

- Surface pitting – 141

- Toe pitting – 26

- More than 900 ore samples

SX-EW plant results

- The pilot plant commissioned in autumn 2017 and produced first copper in November 2017.

- Following remedial work on the leaching pad and collection system in spring of 2018, the plant has reached a steady-state production with PLS ERE grcae of 1.5-1.6 g/L, and average daily production of 200 kg of copper cathode

- Over 36 tons of cathode copper sold on the local market at near LME prices.

- 1.2 km electric line fo the site and 630 kW transformer — completed and connected fo local electric grid

- 400 m access road to the site — completed

- 1.1 km water pipeline fo the site — completed

- Building for the SX-EW pilot plant — completed, insulation and ventilation installed

- 1 km of piping for the heap irrigation — purchased, connected and laid out

- Ponds and collection trenches — completed and lined with geomembrane

SX-EW Business Model

- Planned annual production: 10,000 tons of LME grade “A” cathode copper

- A 23-year copper production contract with the government of Kazakhstan signed in May 2017.

Key production cost drivers:

- Chemicals & Reagents and Power (variable) — favorable geographic location helps keeping these costs low

- Labor and Production Overheads (fixed)

- Mineral Extraction Tax @ 5.7% on value of copper in PLS

- Distribution & Selling — mix of fixed and variable driven by local Infrastructure and T&C of the oft-take contract

Tags:

The information in the catalog is not an exact offer. The parameters of the deal are specified during negotiations with the seller.

Similar adverts

Mining industry

Revenue (year)

9,500,000 $

727,890,950 ₽

727,890,950 ₽

Profit (year)

2,500,000 $

191,550,250 ₽

191,550,250 ₽

Payback (mon.)

Price

17,500,000 $

1,340,851,750 ₽

1,340,851,750 ₽

Mining industry

Revenue (year)

No data

Profit (year)

No data

Payback (mon.)

Price

5,500,000 $

421,410,550 ₽

421,410,550 ₽

Mining industry

Revenue (year)

No data

Profit (year)

No data

Payback (mon.)

Price

7,700,000 $

589,974,770 ₽

589,974,770 ₽

Previously viewed

REAB Services

REAB Services

New artıcles

New artıcles

News

News

Useful tip

Useful tip