Free economic zones in Ghana

Table of contents

Table of contents

The concept of free economic zones (FEZ) is widespread throughout the world and continues to gain popularity. Many African countries, including Ghana, have initiated FEZ programs since the 1990s.

The Ghana Free Zones Authority (GFZA) was created on 31 August 1995 by an Act of Parliament. The Free Zones Act 1995 (Act 504) is intended to:

- ensure the establishment of free zones in Ghana to promote economic development;

- ensure regulation of activities in free zones and related purposes.

The control operates according to the position (LI 1618). The actual implementation of the Program began in September 1996.

The Ghana Free Zones Program is designed to promote the processing and production of goods through the establishment of Export Processing Zones (EPZs) and encourage the development of commercial and service activities at sea and at airports. Essentially, the whole of Ghana is available to potential investors, who have the opportunity to use the free zones as a hub for the production of goods and services for foreign markets.

In Ghana, companies registered with the Ghana Free Zones Authority (GFZA) are taxed at a rate of 1% for the first ten years of their operation, and then at a rate of 15% on income thereafter.

A free zone company is required to export at least 70% of its annual production. In addition, sales to the local market are prohibited from exceeding 30% of annual production. It should be noted that sales to the local market are subject to the customs jurisdiction of Ghana and are therefore subject to tax.

A licensed free zone enterprise has the right to produce any type of goods or services for export, provided that it does not pose a danger to the environment.

Please note, however, that a company must be registered as a body corporate under the Companies Act 1963 (Act 179) or a partnership under the Private Partnership Act 1962 (Act 152) to be eligible for registration under the scheme free zones.

Incentives for free zone enterprises

The main incentive for free zone businesses is that laws relating to the import and export of goods and services (other than consumer goods for business purposes) do not apply to imports into a free zone company or shipment of goods for export from a free zone.

Other incentives available to free zone companies are:

- 100% exemption from direct and indirect duties and taxes on all imports of products and exports from free zones;

- 100% exemption from payment of income tax on profits for 10 years from the date of commencement of activity and income tax in the subsequent period cannot exceed 8%;

- Full exemption from income tax on dividends received from investments in the free zone;

- Double tax relief for foreign investors and employees if Ghana has a double tax treaty;

- No import licensing requirements;

- Minimum customs formalities;

- 100% ownership of shares by any investor, foreign or national, in a free zone enterprise is allowed;

- There are no conditions or restrictions on the repatriation of dividends or net profits, payments for the servicing of foreign loans, payments of commissions and fees under technology transfer agreements and the transfer of proceeds from the sale of any interest in investments in the free zone;

- Ability to manage foreign currency accounts in Ghanaian banks;

- Investments in the free zone are guaranteed protection from nationalization and expropriation.

The Ghana Free Zone Authority has identified 11 areas that are considered priority sectors for free zone investment. These priority sectors are:

- Information and communication technologies [ICT]

- Textile/clothing production

- Agri-food processing

- Seafood processing

- Jewelry/craft production

- Metal/hand tool production

- Floriculture

- Light industry/assembly production

- Production of ceramic tiles

- Pharmaceutics

- Ethnic beauty products

Various versions of the annual reports of the Ghana Free Zones state that the whole of Ghana is officially a free zone and allows SEZ firms to be established anywhere in the country. Thus, SEZ companies operate in SEZ enclaves, which are industrial parks declared as SEZs or as single-plant enterprises outside such enclaves. Official data from the Ghana Free Zone Authority (GFZA) shows that 186 firms were registered as SEZ companies in 2021. In 2021, these firms employed 31,516 people, had a total turnover of US$1.5 billion, and total export earnings of US$424 million.

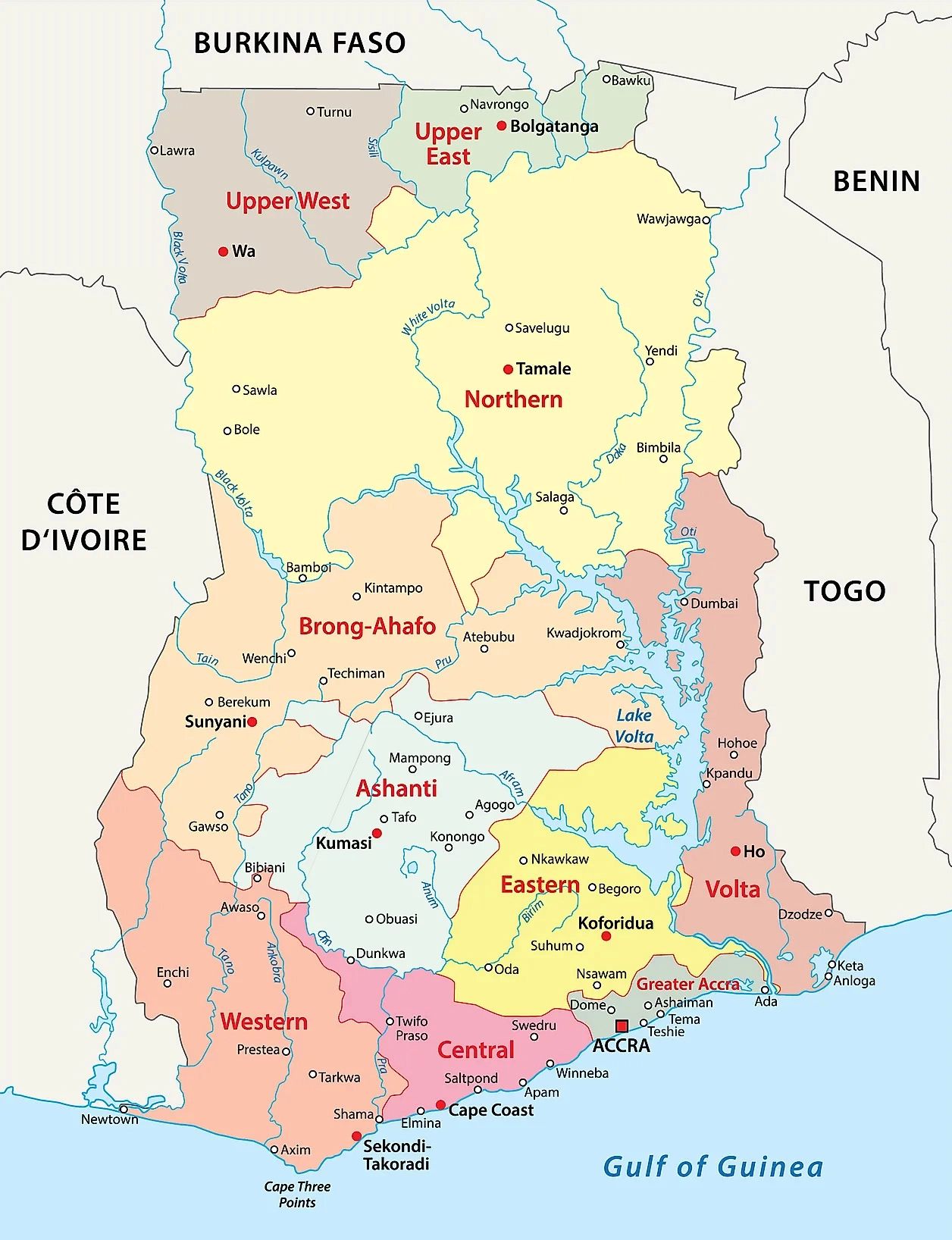

According to the latest UNCTAD data, Ghana has four SEZ enclaves, while the Organization of African Economic Zones has five enclaves. However, to the best of our knowledge, only three enclaves currently contain operating companies. These enclaves are the Tema Export Processing Zone (TEZ), Dawa Industrial Park and the Export Processing Zone (EPZ) in Sekondi. Kumasi Industrial Park and Sharma SEZ are not operational. Other potential SEZ enclaves such as the Accra Silicon Tech City (60 acres) and Apolonia Industrial Park (200 acres) are under development. Further plans are currently underway to develop the Tamale SEZ (4,500 acres) and Builsa SEZ (3,000 acres) in northern Ghana.

EPZs have taken center stage in Ghana over the past two decades, and recent policy announcements indicate that EPZs are seen as instrumental to the industrialization agenda, one of the pillars of the government's Ten Point industrial transformation program announced in 2017. This means that the promotion and implementation of enclaves is of great importance in Ghana.

FEZ enclaves usually represent a complex institutional structure. The agreement includes traditional authorities, property owners, developers, companies and regulators. Traditional authorities grant land to the Government of Ghana, which often represents the GFZA. Through the GFZA, the government either develops the enclave land itself or signs lease agreements with private developers. Sometimes the Ghanaian government may facilitate the creation of some key infrastructure in an enclave before leasing the sites to private developers. Developers (private or GFZA) then lease the land to companies who pay an annual rent for their plots. These companies may be companies within or outside the SEZ. While the GFZA regulates companies in SEZs, companies outside the SEZ are not regulated, even if they are located in an SEZ enclave.

GFZA ensures that SEZ companies comply with the requirement of the 70/30 rule. To ensure compliance with this rule, the GFZA requires all companies to submit quarterly operating reports to their offices. They must contain information about the volumes produced, imported resources, exported products, etc. In addition, private developers in the enclave receive some benefits associated with the SEZ. Thus, the GFZA also monitors private developers to ensure compliance with the conditions associated with the SEZ.

Tema Export Processing Zone (TEPZ)

TEPZ is the largest enclave, employing more than half of the SEZ jobs and one third of the SEZ companies. It is the oldest operating SEZ enclave in Ghana and was officially declared a free zone in 1996. TEPZ is located in Tema, Ghana's main port city, which is adjacent to Accra, the largest residential city and the national capital of Ghana. Subject — one of the fastest growing cities in Ghana with a relatively well-developed infrastructure. Many industrial plants are located in the metropolitan area of Tema, where the skilled workforce is also concentrated. TEPZ covers an area of 1,200 acres and includes about 80 companies, of which approximately 40% are SEZ companies.

The enclave area was developed and managed by private developers and the GFZA. About 700 acres of land are managed by LMI Holdings2 and GFZA, which also acts as regulator and developer.

Before development, the site was covered with small trees and shrubs, and several abandoned residential buildings were in poor condition. Typical of coastal Ghana, the topography of the site was flat and required minimal excavation.

The key sectors of the TEPZ, that is, the sectors that the enclave wants to attract, are currently:

- food industry

- production of building materials

- light industry

- logistics

- machinery and equipment

- textile and clothing industry

- automotive industry.

Food processing firms in the Tema enclave are usually shea and cocoa processing plants. These firms include Niche Confectionery Limited and Cocoa Touton Processing Company Ghana Limited, local producers of cocoa products.

Dawa Industrial Park

Dawa Industrial Park is located approximately 43 km east of TEPZ. The park is located within the larger Dawa City Planned Ecosystem (22,000 acres) and was designed as a special economic zone for the Greater Accra region. The Dawa Industrial Park covers an area of 2,200 acres and is developed and owned by LMI Holding. Before it became an industrial park, the land was primarily used for grazing livestock and growing vegetables. The topology of the territory is similar to the TEPZ, which is a flat plain.

The park was officially opened in 2019 and is currently home to three non-SEZ companies. The Dawa SEZ does not have a specific sectoral focus.

Sekondi Export Processing Zone

The Sekondi EPZ is located in Sekondi-Takoradi, the second port city of Ghana. Sekondi-Takoradi has an airport with regular flights from Accra. The site was officially declared a free zone in 1996, although its development came later. The Sekondi EPZ covers a total area of 2,200 acres. However, information from the GFZA office in Takoradi revealed that the encroachment of private developers and the desire to preserve some historical and cultural sites has led to a re-survey of the Sekondi SEZ. The area of the site is approximately 1600 acres.

Prior to the declaration of this SEZ in 1996, the land was primarily used for the production of food crops, fiber, pasture and other commercial and horticultural crops.

The enclave is occupied by three operating companies that are not part of the SEZ, and one SEZ company under construction. One SEZ company is also located near the enclave. The Sekondi EPZ is focused on specific target industries. Although the Sekondi enclave is still under construction, companies targeted include companies from the following industries:

- agroprocessing

- mining and industrial equipment

- cars and motorcycles,

- food industry.

In all three enclaves, firms can purchase a varying number of plots depending on the size and decision of the company. For example, in TEPZ Red Sea Housing owns about 35 acres of land, and Vehrad — about 8.2 acres. In the Sekondi EPZ, the upcoming Dandote Cement plant occupies over 100 acres of land, while other companies have relatively smaller acreage.

Infrastructure

Availability

TEPZ is located next to the national highway (H1) and thus has quick access to Tema Harbor and the national route network. The harbor is approximately 10 km away. The enclave has both paved and dirt roads, all of which are of average quality. In general, main roads are better developed, while external ones are worse.

Like Tema Enclave, Dawa Enclave is located close to the National Highway (N1) and is easily accessible. However, it is much further from Tema Harbour. In detail the distance to the harbor is 46 km. Its main road is now well developed. The enclave advertises that rail links are planned with northern Ghana and the Sahel countries.

The EPZ in Sekondi is located far from the highway and is difficult to access due to its poor condition.

The poor quality of roads in the enclave is due to the fact that it is still under construction. However, the enclave has its own railway link, which was built specifically to connect it to Takoradi Harbour.

Electricity

Currently, Dawa does not have its own power plant. However, a substation similar to the substation in Tema is now being built, with a transformer capacity of 132 MVA. In addition, by 2030 it is planned to build a solar farm with a capacity of 1 gigawatt in the enclave.

Tema has its own power plant on the territory of the enclave. This power plant operates uninterruptedly and ensures that there are no (or only minor) power outages in the enclave. Enclave Power operates a 165-megavolt-ampere (MVA) power plant to increase power supply to the TPP. In addition, there is 40 MVA of power with an input transmission of 33 kilovolts, powered directly by the Ghana Grid Company.

The EPZ in Sekondi is connected only to the national grid and does not have its own power plant. Thus, enclave businesses must also use the main power grid. In addition, the enclave has its own gas pipeline, which is operated by the national gas supplier, the Ghana Gas Company. Currently, this allows five power plants to be directly connected to the gas network.

Water

National water supplier, Ghana Water Company, provides water supply in Tema. However, to avoid water shortages in the enclave, TEPZ has a water reservoir with a capacity of 2 million gallons: 500,000 gallons for the overhead reservoir and 1,500,000 gallons for the underground reservoir.

Neither in Dawa nor in the EPZ in Sekondi there is such a facility. However, the Sekondi EPZ is established in a region with a relatively large water body. It is planned that companies will be able to use this in the future. In addition, companies in the enclave also have their own dug wells that supply them with water for production activities. Preparations are also underway for the installation of a water treatment plant in the Dawa Industrial Park to supply water from Lake Volta for consumption and industrial use.

Internet

The Dawa Industrial Park and the TEPZ site, managed by private developers, currently have fiber optic connectivity. There are no Internet services in the GFZA section of TEPZ, and tenants must provide this condition for their activities. The same can be said for the Sekondi Export Processing Zone, which is managed by GFZA.

Other topics:

Other topics:

REAB Services

REAB Services

News

News

Useful tip

Useful tip