Support for Russian local manufacturers and a startup from Saudi Arabia. How is it related and what to do about it

Table of contents

Table of contents

The departure of Western companies creates unique conditions for local producers, including small ones. But how to get on the consumer's shelf if you produce craft soda in the Voronezh region? And what about Saudi Arabia? — you ask. I'll explain now.

Domestic producers have a strange situation

Western companies are slowly ending the game of "temporary suspension" and begin to finally wind down business in Russia. Starbucks, IKEA, and now the first major FMCG company — Coca Cola. Apparently, these are only the first signs...

The consumer is hardly amused by this news, but local producers are opening up opportunities never seen before. Every prosperous (more precisely, surviving) domestic manufacturer — this is not only pride in the excellent native products, but also the jobs that are so needed now, and also a beautiful line in the report.

Therefore, the government is actively inventing support measures. Firstly, these are basic general measures designed to give small and medium-sized businesses a chance to breathe a little — tax breaks, moratoriums on inspections, preferential industrial mortgages, and that's it. It would take a couple of volumes to list them all. There are fewer people actually working, but still enough.

However, in addition to general measures, there are also very specific, more targeted ones. For example, back in April, the government announced its intention to develop wholesale food markets. These are the ones like Food City in Moscow or the Kalinin vegetable warehouse in St. Petersburg. Purpose — make it easier for small food producers to reach the end consumer. Also, programs to support exporters of Russian products are restarted and expanded in the so-called. friendly countries.

Markets and export support — this is good, of course. But the main question remains open — how can small and medium-sized domestic producers get on the shelf of retailers (preferably large federal chains)? Even in conditions of slightly reduced competition due to the departure of Western giant manufacturers, most small producers will not have enough human and financial resources for this. Some advanced retailers, of course, have cooperation programs with small (even craft) producers of food and other fmcg products. But this is a drop in the ocean.

The solution may be found where it was not expected. More precisely, it can be seen somewhere. Do we like to copy foreign "best practices"? And then there is a rare situation when these same practices can be borrowed from a "friendly" country...

So what does Saudi Arabia have to do with it?

Attention, a question! What do you know about Saudi Arabia?

Most of the inhabitants have heard that this is a very closed, mysterious and deserted country somewhere near the Persian Gulf. And in this country, hands are chopped off for theft, and it is here that the famous Mecca and Medina are located.

Slightly more knowledgeable know that this country is the largest and most authoritative member of OPEC and has incredibly huge reserves of cheap oil. Its cost is really extremely low — practically "poked a stick in the sand and framed the tanker."

The most knowledgeable know that Saudi Arabia has embarked on a course of serious changes in recent years. From a harsh closed theocratic monarchy, the Saudis are trying to transform into an attractive country for tourism with an advanced economy. And most importantly, the country wants to get off the oil needle, for which it is actively developing industries not related to black gold. The quintessence of this course was the vision of the country's development by 2030 called Saudi Vision 2030 (I advise go over the — curious document).

There are also start-ups in Saudi Arabia. The state has recently been actively helping their development and even (oh no!) investing. We need one of these Saudi startups.

A digital platform that connects suppliers of all kinds of products with retailers

Sary is often called as a "main" Saudi Arabian startup and one of the largest startups in the Middle East.

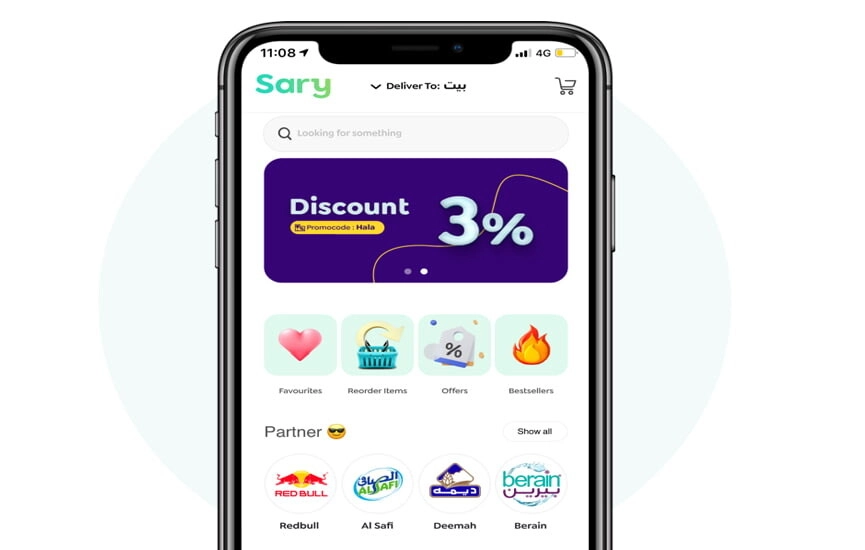

Sary is a B2B marketplace that allows retailers (both a large hypermarket and a small Uncle Ahmed store in the yard) to replenish their warehouse stocks and display of the trading floor with food and other goods directly from suppliers. Manufacturers upload their product range to the platform and update their available quantity and price in real time. Retailers can then select and order the products they need.

The functionality of Sary includes three components:

- Platform-marketplace. Section with a cataloged list of products and product cards. It is not much different from the online stores familiar to all of us. Filter by categories/products/brands, description and key features, illustrations, reviews... There are some B2B specifics, like special offers for wholesale.

- Logistics capacity that allows you to deliver the ordered goods to the seller's shelf within 24 hours (according to the assurance of the service itself). By the way, Sary often positions fast logistics as a key advantage of — they say, it is possible to instantly replenish falling stocks, depending on changes in demand for certain goods. That allows you to improve the performance of trading right in the process.

- Payment functionality. You can pay in cash upon receipt of the goods, with a MADA system card of any bank in the country (something like the Saudi equivalent of the MIR card payment system) or through the SADAD system (this is the national B2B electronic payment system). Payments are fully facilitated by Sary.

In fact, the supplier just needs to create a personal account in the service and upload his product there, following the basic rules of SEO. And then Sary will take care of getting the goods on the retailer's shelf.

Right now, the service provides access to >30K SKUs in a variety of categories. Sary founders Mohammed Aldossari and Khaled Alciari launched the service in just 2018. Since then, the startup has managed to attract several large rounds of investments, and not only from Middle Eastern funds. Now Sary is actively expanding to other countries — for example, it buys marketplaces and logistics services (including last-mile) from Egypt, Pakistan and other countries in its region and around.

According to the Google-translated pages of exquisite Arabic script, the essence of the business model (and along with the mission) of Sary — help small merchants restock products from large and medium-sized suppliers. It is this format that is the most popular and in demand. However, the opposite also happens. The service also includes small suppliers. Up to completely garage-craft, the main thing is that there is a trademark and compliance with not very strict safety and quality criteria. That is, there is also the interaction of "small producer" — "small retailer". Format "small producer" — "major retailer" it also happens, but, apparently, a little less often.

We are very happy for the Saudis, but what do we care about this?

We have a ready-made example of a successful fast-growing service, whose business model could be a significant help to domestic manufacturers, many of which are right now in a state of fragmented chaos (although they produce a decent product).

A particularly useful measure of support would be just the third format of interaction ("small manufacturer" «large retailer"), but other formats would not hurt at all.

Let's return from the hot Arabian sands to Mother Russia. How can a similar model be implemented here in practice? I will highlight 3 options:

- New project from a private player. The most unlikely scenario. It is difficult with start-up construction in the country now. It’s not easy to justify a growth of twenty times in a pitch, but they won’t finance it for another.

- A new direction for one of the major marketplaces — Yandex.Market, Ozon, Wildberries and others like them. A slightly more likely scenario, however, large consumer services will now, on the contrary, cut unnecessary features in order to focus on the most marginal functionality. And new ones will be introduced very carefully and precisely.

- Based on the experience of similar projects, I would venture to suggest that the most likely scenario for — third. Namely, the launch of a digital platform with state participation (full or partial).

You can kill two birds with one stone: launch a very effective tool for supporting local players, while pushing this tool into the marketplace. Wrapped up in a beautiful concept and business plan, officials from relevant ministries should not pass by.

Moreover, something similar was done two years ago with agricultural producers. Then the creation of a digital platform with a built-in marketplace was given to the Russian Agricultural Bank. The platform was washed down, called Own Farming. It even seems to work (but this is not accurate). So why not expand to other products outside of agriculture?

Other topics:

Other topics:

REAB Services

REAB Services

News

News

Useful tip

Useful tip