Free economic zones in Kenya

Table of contents

Table of contents

Kenya is one of the African countries where there are huge opportunities and prospects for investment. In 2019, Kenya's ranking in the World Bank's Ease of Doing Business Index (EODB) improved to become the 56th most competitive economy in the world and the 3rd most competitive in Africa.

Kenya's strong economic potential as a leading economy in East and Central Africa, as well as its strategic position as a regional financial, communications and transport hub, provide investor confidence. Kenya's economy has grown steadily over the past decade, with the exception of 2020. The growth of the country's GDP over the past 10 years averaged 5.5%. Key sectors of the economy include agriculture, manufacturing, real estate and services. Agriculture remains the backbone of the economy, accounting for about 53% of GDP, manufacturing accounts for 10%, and has grown significantly over the years to become the second largest contributor to GDP.

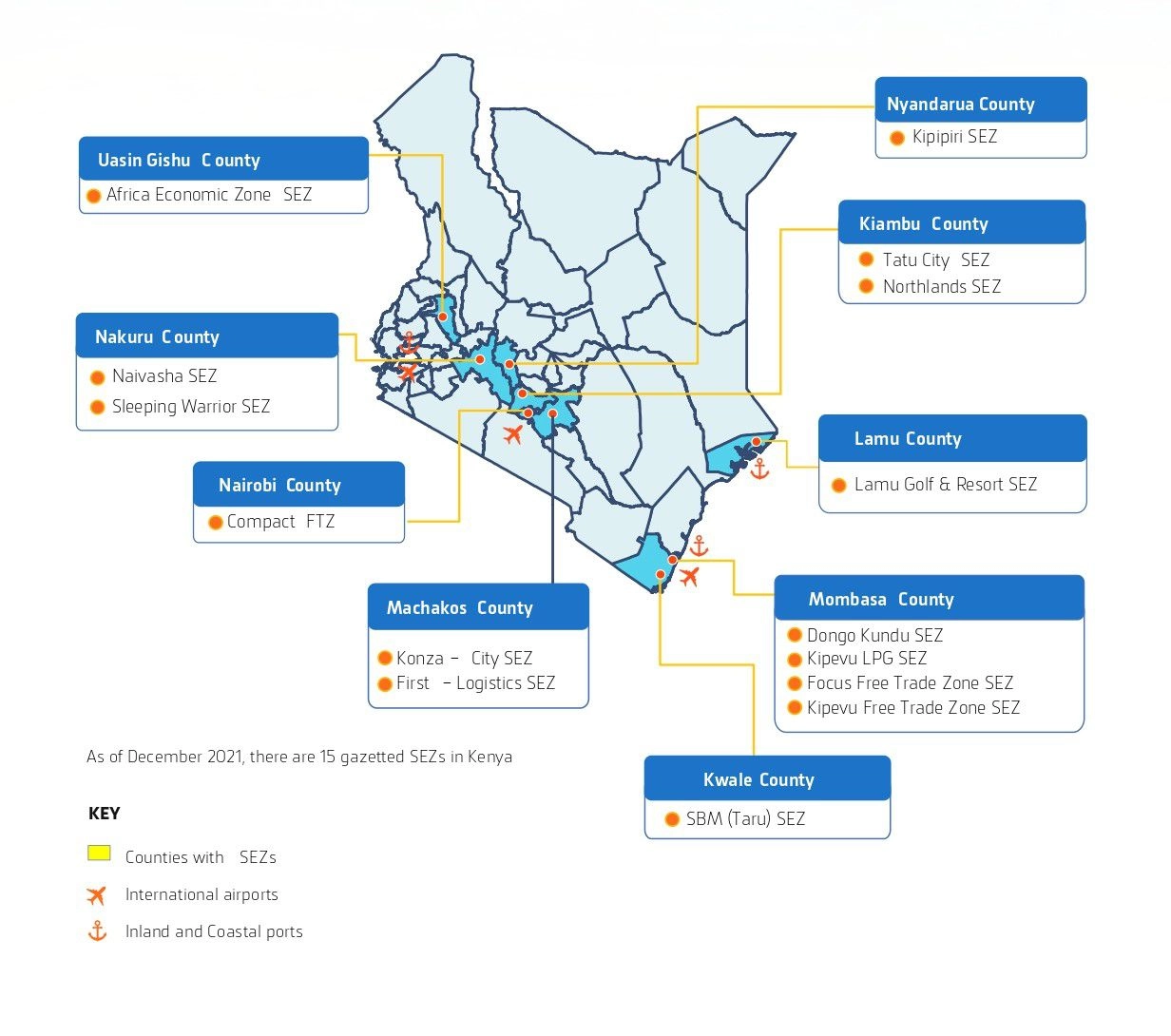

Special Economic Zones established and designated under the Special Economic Zones Act 2015 are designated geographical areas. It implements a policy that promotes business development. Sector-appropriate internal and external infrastructure, utilities are provided by the Government of Kenya. Under the SEZ regime, participating investors can benefit from favorable trading conditions. Notably, the Law highlights integrated infrastructure facilities, business access and economic incentives, and the removal of trade barriers and impediments as the main benefits provided by the FEZ regime.

When looking at SEZ incentives, the main benefit in Kenya is the tax shields offered under SEZs. In particular, from a tax standpoint, FEZs are considered to be outside the customs territory of Kenya and thus operate within a jurisdictional circle that protects them from taxes and similar regulatory barriers that directly or indirectly discourage trade. Consequently, licensed SEZ enterprises, developers and operators enjoy various tax incentives such as exemption from excise, customs duties, value added tax and stamp duty, preferential corporate income tax rates and preferential withholding tax rates, especially with regard to repatriation of profits. SEZs offer infrastructure support, incentives and services to facilitate business operations within the zone. FEZs can access Kenya market, EAC market, COMESA market, international trading partners.

State free economic zones

1. SEZ DONGO KUNDU

Designer/Operator: SEZA

Location: Mombasa District.

2. SEZ NAIVASH

Designer/Operator: SEZA

Location: Nakuru County.

3. SEZ "KONZA TECHNOPOLIS"

Developer/Operator: Konza Technopolis Development Department

Location: Machakos District.

4. SEZ MOMBASA INDUSTRIAL PARK

Designer/Operator: Mombasa County

Location: Mombasa District.

Private SEZs

1. SEZ "TATU CITY"

Designer/Operator: Tatu City

Location: Kiambu District.

2. AFRICA ECONOMIC ZONES SEZ

Designer/Operator: FEZ African Economic Zone

Location: Wasin Gishu County.

3. SEZ COMPACT FREE TRADE ZONE

Builder/Operator: SEZ "Compact Free Trade Zone"

Location: Nairobi District.

4.SEZ NORTH

Builder/Operator: SEZ Northlands

Location: Kiambu District.

5. SEZ GOLF AND RESORT MOUNT KIPIPIRI

Builder/Operator: SEZ Mount Kipipiri Golf & Resort

Location: Nyandarua County.

6. SEZ FREE ZONE IN EAST AFRICA

Designer/Operator: East Africa Free Trade Zone FEZ.

Location: Mombasa District.

Investment opportunities provided by the Government of Kenya

Free port zone

A defined zone, which is at the disposal of the administration of a special economic zone or free port, where goods entering the specified zone are usually considered to be outside the customs territory for import duties.

Free Trade Zone

The customs control area of a special economic zone in which goods are unloaded for transshipment, storage and may include bulk cutting, repacking, sorting, mixing, trading or other forms of processing other than production and processing.

Business service parks

Special Economic Zone to facilitate the provision of services, including but not limited to regional headquarters, business process outsourcing centers, call centers, shared service centers, management consulting and consulting services, and other related services.

Business service parks

A site with ready-to-use tools for maintaining office networks and back office support services.

Industrial parks

Special economic zone with a comprehensive infrastructure to meet the needs of industrial and processing industries. Industrial parks are usually zoned for industrial use rather than residential or commercial use.

Agricultural zones

Special Economic Zone with infrastructure to improve value chains in the livestock, agricultural sector and related activities and services.

Science and technology parks

Special economic zone for the development of the scientific and technical sector, its services and related activities. It is designed to attract companies and research activities.

Tourist, recreational and conference areas

Special economic zone for the development of the tourism and recreation industry, its services and related activities.

Other topics:

Other topics:

REAB Services

REAB Services

News

News

Useful tip

Useful tip