Analysis of the technology market in Africa: while China is investing billions in it, local authorities are slowing down growth. Part 1

Table of contents

Table of contents

How it works, who and why attracts multimillion-dollar investments from China and the United States, and why the authorities are hindering its development — in the retelling of The Generalist's analysis. Start.

Demography in Africa

Ethnogeographically, Africa is larger than Europe, the USA, India and China combined:

- More than 1.2 billion people live on the African continent.

- They speak over 2000 languages.

- It has over 3,000 indigenous peoples in its 54 countries.

Investors, however, are not interested in the country's heritage, but in its future — and this is how it will be according to experts' forecasts.

The population and the number of young people will increase

Today, Africans make up 16% of the world's population, but by 2050 this figure will increase to 25%. This is because the continent's population is expected to double to 2.4 billion. This, according to the publication, can increase its influence on the global economy.

Half of Africans will live in five countries:

- In Nigeria — 411 million

- In Ethiopia — 191 million

- In Egypt — 153 million

- In the Democratic Republic of the Congo — 197 million

- In Tanzania — 138 million

The average age of the population will also decrease: about half of the 2.4 billion will be under 25 years old. And, as The Generalist suggests, in half a century, more young people will live on the continent than in all the G-20 countries combined.

And as population growth has slowed in many advanced economies, organizations in need of employees will be able to find them in Africa, the newspaper writes.

Africans will live better and buy more

By 2030, the African middle class will reach 580 million, and the upper class will increase by 116 million. Together, both classes will surpass the US population, writes The Generalist.

As of 2021, the average American earns more than the African, with a daily household income in the US of approximately $200, while some Africans earn as little as $2. However, as population growth and urbanization increase, so too will Africa's purchasing power.

The continent's consumer spending could reach $2.1 trillion by 2025 and $2.5 trillion by 2030. In the US, they amount to 12 trillion US dollars, while in India they are approaching 1 trillion US dollars.

More Africans will go online

In 2021, only 22% of Africans have internet access, while 45% of sub-Saharan Africans use phones. In such conditions, it is difficult for the technology market to flourish, but the situation is gradually changing, the publication notes: back in 2005, only 2% of Africans could access the Internet.

Key Markets in Africa

According to a report by Partech, 26 African countries raised $1.43 billion in 2020. On a market-wide scale, the money is small, the newspaper writes: global investment in 2020 amounted to $ 300 billion, and Africa received only 0.5% of the amount.

However, according to The Generalist, this is also a step forward: 10 years ago, there were practically no injections, and since 2015 their volumes have been increasing annually by more than 40%.

True, funds are distributed unevenly: 80% of all funding falls on only four states — Nigeria, Kenya, Egypt and South Africa.

Investment in African countries in millions:

- Nigeria — USD 307 million

- Kenya — 305 million USD

- Egypt — USD 269 million

- South Africa — USD 259 million

- Libya and Madagascar attracted less than a million

(The Generalist, Partech).

Nigeria — the most developed, according to The Generalist, the market of the continent:

Nigeria has a population of 200 million.

The country has an experienced technical staff and a network of business angels.

Nigeria has many successful financial startups like Flutterwave and Interswitch, and its vast fintech sector is still growing.

Kenya — the agricultural center of Africa with a population of approximately 50 million. It is its startups that account for 79% of all investments in the field. The country owes much of this to the analytical startup Gro Intelligence, which raised $85 million in 2020.

Gro Intelligence collects climate and market data from which it builds models and forecasts. They help companies understand if they need to increase production, where the best soil is, and if droughts are foreseen.

Egypt dominates in logistics and education technology, leads in the number of transactions in 2020, and also bypasses Nigeria, Kenya and South Africa in investment: the volume of capital invested in it increases by 28% annually.

Moreover, not only local investors are showing interest. Recently, the Egyptian neobank Telda received $5 million from the American venture capital fund Sequoia.

South Africa is richer than Nigeria, Kenya and Egypt in terms of GDP per capita and leads in the field of enterprise software: it attracts almost half of all investments in the sector. South Africa is also home to major media groups like Naspers.

According to the publication, French-speaking African countries receive significantly less investment than English-speaking countries: in 2019, they attracted only 54 million US dollars. However, the region has prospects, according to The Generalist, since it is he who, according to the World Bank, will provide 62.5% of the growth of the entire continent.

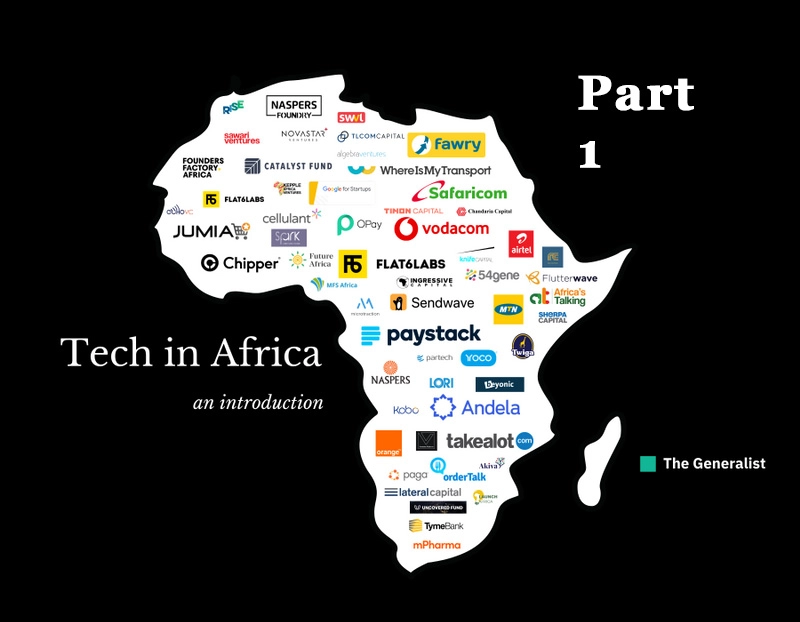

Key Players

In order to get a general idea of the African market, The Generalist studied its main participants — accelerators, corporations, startups, hubs and investors.

Startup accelerators

Accelerators — important players in the startup world: they mentor entrepreneurs, help them make friends and attract investments. One of them — American Y Combinator, which has launched 49 African projects since 2015, including Flutterwave and Paystack payment gateways.

Among the "graduates" Y Combinator is also 54Gene medical research company and Helium Health medical technology developer; logistics firm Kobo360 and cryptocurrency platform Buycoins.

Along with YC, the business is also supported by other American accelerators, such as Techstars. He opened a branch in Africa and promoted financial platforms Eversend and OnePipe, logistics service Max.ng, and medical MDaaS Global.

American Village Capital, in addition to investing in agricultural and financial startups, launched a training program for entrepreneurs — in English-speaking, French-speaking and Portuguese-speaking countries in Africa.

And finally, the Google accelerator: the company has worked with 50 African startups in 17 countries, and this seems to be just the beginning, the newspaper writes, since half of the startups joined the program just last year.

Corporations

The main players in the African technology market — mobile banking and mobile operators. Among the largest:

- Transnational MTN Group and Airtel Africa.

- Kenyan Safaricom.

- South African Vodacom.

- Senegalese Orange Group.

Many of them are supported by the local government.

Corporations nurture startups, as well as become their clients and investors. In 2012, the MTN Group, operating in 15 African countries, invested in the online store Jumia Group and subsequently earned about 160 million US dollars from it.

Founded in 1915, the Naspers media group also supports start-ups by launching the $100 million Naspers Foundry.

Sometimes corporations have to compete with young ones. To keep their positions, they open subsidiaries. So did MTN and Airtel by launching their own mobile banks. The first is estimated at 5 billion US dollars in 2021, and the second — in 2.65 billion US dollars.

Another example of — an ongoing dispute in Senegal between Orange Corporation and Wave startup, which attracted users largely due to low commissions, the newspaper writes. At the risk of losing influence, Orange drastically reduced fees for similar features and closed access to Wave through its network.

Startups

The first African startup to list on a major international stock exchange was the online clothing and electronics retailer Jumia, which went public on the New York Stock Exchange in 2019.

In August of the same year, the payment service Fawry floated its shares on the Egyptian Stock Exchange. At that time, its market capitalization was 1 billion US dollars, and after the sale of shares, it doubled.

In 2020, the interest of the American company Stripe was attracted by the Nigerian payment gateway Paystack. The US$200 million deal was Stripe's largest and allowed it to enter the markets of Nigeria, Ghana and South Africa. Britain's WorldRemit followed suit with a $500 million acquisition of fintech startup Sendwave.

And in 2021, the payment company Flutterwave was one of the few companies in Africa that was able to raise more than $200 million in investments ($225 million). Private investors Avenir Growth Capital and Tiger valued it at more than $1 billion.

Among successful African companies — payment and transport applications, medical, logistics and financial services, online stores (The Generalist).

Hubs or social structures

In Africa, there are analogues of accelerators — hubs, "social structures" for collaboration. The most famous example of — Co-development Center in Nigeria: it helps develop and launch projects, and also has its own investment fund.

Nigerian hub "released" founders of many African startups and attracted the attention of the main players in the tech sector: Facebook founder Mark Zuckerberg, Twitter founder Jack Dorsey and GitHub CEO Nat Friedman.

The African Private Equity and Venture Capital Association also operates on the continent. It brings together institutional and private investors at the regional level and stimulates funding.

Venture capitalists

If there is an analogue of the American Sequoia fund in Africa, then it is Partech, the publication believes. In January 2019, the company raised 125 million euros (149 million US dollars) by connecting more than 40 investors. Among them are the European Investment Bank, the World Bank and the German State Bank, as well as the Dutch Development Fund.

Foreign funds tend to invest in more mature companies. Africa, on the other hand, often invests in projects at the "seeding" stage, notes The Generalist.

Other topics:

Other topics:

REAB Services

REAB Services

News

News

Useful tip

Useful tip